Leveraging IoT and Data Analytics in Parking Garage Investments

-

Last Updated:

17 Feb 2026

-

Read Time:

11 Min Read

-

Written By:

Isha Choksi

Isha Choksi

-

17

Table of Contents

Tech-enabled parking turns garages into measurable businesses. Explore the IoT stack (capture, transact, control, analyze), core NOI drivers (pricing, reservations, leakage, staffing), KPIs like RevPOSH, contract and data export checks, phased rollouts, a

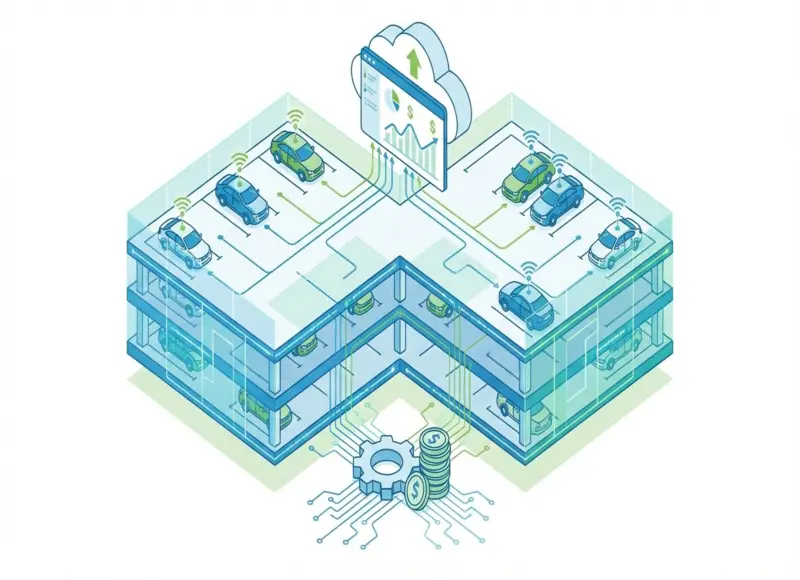

IoT and analytics turn parking from "space" into an operating business

Parking garage investments are increasingly being evaluated less like "static square footage" and more like operating businesses. With smart parking tools and parking data analytics, demand becomes visible by hour, pricing becomes testable, and operational leakage becomes harder to ignore. That's a material shift for owners who care about predictability and downside protection. If you're comparing garages for sale, this operating-business lens is what separates a "full-looking" asset from a truly performing one.

Experts' approach is simple: IoT in parking is only valuable when it's tied to investable outcomes - NOI lift, volatility reduction, and a cleaner tenant / visitor experience. Sensors and dashboards are not the goal. Better performance, fewer surprises, and faster corrective action are the goal.

The market context: why tech-enabled parking is accelerating

Parking tech spending is growing

Parking management technology is scaling as a category. A 2025 market estimate projected growth from about 7.22B in 2025 to 12.41B by 2030, roughly an 11.4% CAGR. This isn't proof that every upgrade pays off, but it is a sign that digitization is becoming normal-especially around payments, enforcement workflows, and labor efficiency. Operators are under pressure to do more with less, and "manual everything" is losing.

Smart parking is expanding

Smart parking market estimates also point to growth, with one outlook estimating about 6.3B in 2025 expanding to 15.8B by 2034. That growth comes with fragmentation. Occupancy sensors, guidance systems, and curb-to-garage tools vary widely by quality and integration maturity, so investor diligence matters more, not less. The vendor landscape is crowded, and the same feature name can mean different capabilities.

EV adoption increases the value of "instrumented" parking

EV share is rising; the IEA reported U.S. electric car sales exceeding "more than 1 in 10 cars sold." As charging becomes part of parking, utilization analytics and load management start to affect revenue and tenant satisfaction.

What IoT in a parking garage actually includes

The four data layers: capture, transact, control, and analyze

IoT in parking can feel like a blur of sensors, cameras, apps, and acronyms. A clearer way to think about it is as four layers that each do a different job.

Capture is how the garage measures reality: occupancy detection, gate counters, cameras, and sometimes ALPR. This layer answers, "What happened, when, and where?" Transact is how money and permissions move: mobile payments, pay stations, reservations, validations, and monthly account billing. Control is the rule engine: access control, pricing rules, enforcement workflows, and exception handling-basically, "What should happen next?" Analyze is where performance becomes usable: dashboards, forecasting, anomaly detection, and reporting that translates activity into decisions.

Integration points are where projects succeed or get stuck. A single-vendor promise can sound comforting, but it can also mask lock-in, limited data export, or weak best-of-breed options. The company typically looks for a stack that can connect cleanly, export data reliably, and survive vendor changes without a total rebuild.

Where data analytics creates value: NOI drivers and risk reduction

Revenue lift levers

Parking revenue optimization works best when pricing is disciplined, not reactive. Analytics supports yield management by showing true demand patterns-by hour, day, season, and event type-so pricing isn't based on gut feel. That enables event or peak pricing that actually matches demand, rather than leaving money on the table or overpricing into emptiness. It also supports reservations and prebook strategies that reduce unused peak capacity, especially when demand spikes are predictable.

A common scenario is a garage near a stadium or arena. Weekdays might be steady but price-sensitive; event nights are short windows where demand is intense and the "right" price is different. With data, the garage can allocate inventory intentionally: protect some spaces for high-margin transient parking on event nights, while managing monthly and validated demand so it doesn't choke peak revenue. Without data, the garage often does the opposite-fills up with low-margin parkers and then turns away the highest-value demand at the curb.

Leakage and compliance control

Analytics also makes it harder for "soft loss" to hide. Revenue leakage doesn't always look like theft; it can be exceptions piled on exceptions: tailgating through gates, manual overrides, validation abuse, unpaid exits, and exception-heavy cashiering that becomes a habit. When exception reporting is weak, these issues get normalized, and the asset quietly underperforms.

Red flags the company watches for in reports:

- Override rate that climbs over time

- Free-exit frequency that can't be explained by policy

- Mismatch between entries and paid exits

- Unusually high validations relative to tenant agreements

- Spikes in "lost ticket" or "manual adjustment" events

Leakage control is often one of the fastest paths to defensible NOI lift because it fixes what should have been collected in the first place.

Cost reduction and service consistency

On the cost side, demand forecasting helps staffing match reality. A garage doesn't need the same labor model on a flat Tuesday morning as it does on a Friday event surge. Device health monitoring also matters more than many owners assume. When pay stations fail or gates go down, it's not just a maintenance ticket; it's a customer escalation, a traffic jam, and frequently a revenue hit.

Predictable staffing on peak days, fewer outages at gates and pay stations, and fewer angry customer interactions all feed the same outcome: more consistent performance with less operational drama.

Investment risk reduction

Better data reduces investment risk by improving underwriting and asset management reporting. It helps investment committees understand utilization risk, seasonality, tenant churn exposure, and hybrid work variability without relying on anecdotes. It also enables faster corrective action-when performance changes, owners can see why and respond, instead of waiting for month-end surprises.

The metrics that matter: a parking garage operating dashboard

KPI set for investors and operators

A good parking operations dashboard is concise and repeatable. The company typically prioritizes a KPI set that answers "How full is it, how profitable is it, and where is it leaking?" Core metrics include:

- Occupancy/utilization by hour and day

- Revenue per occupied space-hour (RevPOSH)

- Transient vs monthly mix and churn

- Average length of stay and price realization

- Exception/override rate

- Equipment uptime and incident counts

- EV charger utilization (if applicable)

Each KPI has a job. Utilization shows demand shape, not just totals. RevPOSH connects pricing to time, which helps compare days with different dwell patterns. Mix and churn clarify whether the garage is leaning too heavily on one product. Exception rate exposes leakage risk. Uptime and incidents protect the customer experience and cash collection.

Common data pitfalls can quietly corrupt the dashboard: inconsistent timestamps across systems, duplicate vehicle IDs, missing reconciliation between entry/exit counts and payment records, and validation rules that aren't logged cleanly. If the data can't be reconciled, "insight" becomes decoration.

Due diligence for tech-enabled parking garage investments

Buyer's checklist: systems, contracts, and data quality

The company's acquisition diligence for tech-enabled garages focuses on what can be proven, exported, and supported. A buyer should verify the age and condition of the PARCS and payment stack, including vendor lock-in risk and end-of-life timelines. Data ownership and exportability should be explicit; if the buyer can't pull raw transactions and event logs, analytics will always be limited. Integrations should be mapped: ALPR, reservations, validations, access control, and any tenant systems that touch parking.

Support terms matter more than they sound on paper. SLAs and maintenance agreements should be reviewed for response times, parts availability, and escalation paths. Cybersecurity posture expectations should appear in vendor agreements-especially if devices have remote access.

A common hidden issue is proprietary data formats that make reporting look "fine" inside the vendor portal but prevent deeper analysis or switching providers later. Another is outdated firmware on gates or pay stations that leads to intermittent outages-small failures that become big revenue and experience problems.

Implementation roadmap: pilot-to-scale without cash flow disruption

Phased rollout plan

A disciplined parking technology rollout protects cash flow by sequencing change. Phase 1 is baseline measurement: validate counts, occupancy patterns, and payment reconciliation so everyone trusts the starting point. Phase 2 delivers quick wins-standardized reporting, tighter exception controls, clearer signage, and app payment adoption that reduces friction. Phase 3 adds advanced analytics: forecasting, dynamic pricing rules, and predictive maintenance alerts that prevent outages. Phase 4 is portfolio scaling, where benchmarking becomes possible and underperformance becomes easier to spot.

Governance makes or breaks the rollout. Data needs an owner. Alerts need a responder. And there should be a weekly operating cadence-review the dashboard, audit exceptions, confirm device health, adjust pricing rules, then repeat. Pilots should be selected for variability; a garage with peaks and event swings is a better testbed than an asset with flat demand, because the levers show up faster.

Cybersecurity, privacy, and compliance: make IoT investable

Security-by-design requirements for IoT deployments

Parking IoT expands the attack surface. Cameras, sensors, ALPR, pay stations, and remote support tools introduce devices that can be targeted, misconfigured, or simply forgotten. Investors should require security-by-design controls that align with recognized IoT cybersecurity guidance: device inventory, patching processes, network segmentation, and vendor lifecycle support that doesn't end when the installation crew leaves.

A practical minimum bar for investable deployments:

- Asset inventory: what devices are installed, where, and who manages them

- Secure remote access controls: least privilege, MFA, and audited access logs

- Logging and anomaly detection: visibility into unusual activity and failures

- Firmware update commitments: clear responsibility and timelines in contracts

- Privacy policy for license plate data and retention: what is collected, why, and for how long

- Incident response responsibilities: who investigates, who fixes, and who communicates

Without these basics, the "smart" garage becomes a risk multiplier.

Common misconceptions and overlooked opportunities

Misconceptions that break ROI

Three myths repeatedly break smart parking ROI. First: sensors automatically increase revenue. What actually happens is sensors generate more data-useful only if pricing, enforcement, and operations change. Second: dynamic pricing is set-and-forget. In reality, it needs guardrails, review cadence, and event calendars, or it drifts into customer anger or missed revenue. Third: data volume equals insight. Bad data at scale just creates bigger confusion, faster.

Overlooked opportunities

Some of the best opportunities are quieter. Portfolio benchmarking can surface underperformance quickly-why one garage with similar demand produces lower RevPOSH or higher exceptions. Data can also support renegotiating management fees or tightening SLAs, especially when performance issues are measurable. And EV charging analytics can guide where to expand chargers, how to price charging time, and how to manage utilization so chargers don't become all-day storage.

Closing: investor checklist for data-driven parking upgrades

Decision-ready checklist

A strong data-driven parking strategy looks boring in the best way: measurable baselines, clear ROI hypotheses, exportable data, reliable operations, and a weekly operating cadence that turns dashboards into decisions. Before approving upgrades, the company looks for:

- A trusted baseline (counts, occupancy, payment reconciliation)

- A clear value thesis (revenue lift, leakage control, OPEX reduction, or all three)

- Data ownership and exportability (no "black box" dependence)

- Operational reliability (uptime, support responsiveness, exception discipline)

- Security controls (inventory, segmentation, patching, privacy, incident response)

- A cadence for action (weekly reviews, audits, and adjustments)

Final go/no-go test: if the data cannot be trusted, analytics will not deliver-no matter how modern the hardware looks.