Table of Contents

Small businesses face growing risks, ranging from data breaches to legal disputes. Learn how leveraging IT services can strengthen protection and reduce liability.

Operating a small business is usually a roller coaster of emotions with both thrill and anxiety. The owners invest their moments, efforts, and finances to create a lasting one but risks are always lurking. A customer not happy, a breach of data, or a quarrel over a contract can lead to liability issues that endanger the very existence of a company. Especially for the little firms, a single legal case or an unplanned cost could bring the growth strategy to a standstill or even result in shutting down.

It is good to know that the technology has begun playing a very critical role in assisting small businesses in remaining secure and complying. Now, business owners know their risks; take appropriate IT measures; and draft policy at digital and operational levels in order to protect their companies and conduct their work confidently.

Understanding Liability Risks for Small Companies

Liability comes in many forms, and small companies are often more vulnerable than large corporations because they have fewer resources to cushion financial setbacks. Some of the most common risks include:

- Customer Injuries: Physical stores or offices can face liability if a visitor is injured.

- Employee Mistakes: Human errors, including sending the wrong client data or deleting important files, can lead to losses.

- Data Breaches: With increased digital operations, cyberattacks and data theft pose serious legal and financial risks.

- Contract Disputes: Miscommunication in project scope, especially in digital or IT projects, can lead to financial claims.

- Reputational Harm: Online reviews, data misuse, or misrepresentation can result in both legal and brand damage.

Recognizing these potential liabilities is the first step toward building a protection strategy that shields the company and ensures long-term success.

The Importance of Digital Policies and Procedures

One of the most straightforward, yet very effective ways to protect a business from any liability is to invest in explicit written policies and digital procedures. These policies state exactly how an employee is supposed to operate; they also secure the company with respect to cybersecurity and statutory regulations.

For instance, data protection policies can lessen the chance of data breaches; IT usage agreements declare what behavior is acceptable online. Similarly, an SLA with IT support or software vendors can keep a grudge from interfering with the business at a point when responsibility for the matter is pertinent. Even the simpler policies, like requiring employees to report suspicious incidents immediately, can bring about such a positive difference.

Training employees to observe these procedures is as important. The company is better protected when employees understand digital security, privacy practices, and operational protocols.

Contracts and IT Service Agreements as Shields Against Liability

Contracts are a vital tool for managing risk and remain one of the most powerful tools for small businesses, especially in the digital age. Every engagement, whether with clients, vendors, or IT partners, should be backed by clear written agreements.

Well-drafted contracts can:

- Define project scope and data-handling responsibilities.

- Limit liability by including cybersecurity and confidentiality clauses.

- Set dispute resolution methods, such as mediation or arbitration.

- Clarify SLAs and uptime commitments for IT systems and cloud platforms.

Collaboration with capable IT service providers with the knowledge of compliance (example in the case of GDPR or HIPAA) also reduces the risk. Furthermore, such experts can apply ethical and legal regulations when drafting out the agreements.

Protecting Employees and Workplace Technology

Employees are both a company’s greatest asset and a potential liability. Injuries at work, unsafe practices, or improper behavior can create financial, legal, and reputational damage. Small businesses should focus on cultivating a safe and respectful workplace while leveraging technology to minimize risks.

Traditional workplace safety measures remain important:

- Workplace safety training and regular inspections help prevent physical accidents.

- Providing proper protective equipment for roles involving physical work is non-negotiable.

- For office environments, addressing ergonomic concerns, fire safety measures, and secure hardware setups is critical.

In addition, businesses should implement policies that promote respectful interactions among staff. Harassment, discrimination, or hostile work environments can lead to lawsuits that are costly both financially and emotionally.

Technology and IT services play an increasing role in employee safety and compliance:

- Digital reporting tools allow employees to quickly report incidents or hazards.

- Monitoring software ensures compliance with workplace protocols and IT security policies.

- Remote work solutions with secure access reduce physical and digital risks.

- Training platforms deliver interactive courses on safety, harassment prevention, and cybersecurity awareness.

Traditional safety measures, instead of sufficing alone, can be coupled with the current IT-driven solutions to improve the chances of creating a workplace that is considerate and conducive to small businesses, ensure employee safety, lessen risks, and establish a culture of accountability amongst others, which will promote growth for the business in the long run.

The Role of IT Services in Reducing Liability

Technology is both a source of risks from cyberattacks and a key line of defense. Partnering with trusted IT service providers helps small businesses build strong, secure foundations.

Practical IT strategies include:

- Cloud-based backups to prevent data loss.

- Managed IT services that ensure systems are updated and secure.

- Cybersecurity solutions such as firewalls, encryption, and threat monitoring.

- Data compliance support for regulations like GDPR, HIPAA, or CCPA.

- Business continuity planning to minimize downtime after incidents.

Even small businesses that don’t consider themselves “tech companies” benefit from professional IT support. Without it, the risk of liability from data breaches or system failures grows significantly.

Insurance as a Foundation of Protection

Despite all preventive measures, no system is really safe from failure. Insurance, therefore, is an absolute fallback in the event of any mishaps. Modern-day insurance policies for small businesses may incorporate cyber liability protections, which are quite crucial in today's interconnected world.

Different types of insurance offer different protections:

- General Liability Insurance – Covers physical injuries or property damage.

- Professional Liability Insurance (Errors & Omissions) – Covers mistakes or negligence in services.

- Cyber Liability Insurance – Covers data breaches, ransomware attacks, and related damages.

Securing the right coverage helps ensure that one incident doesn’t jeopardize years of effort and growth. For example, obtaining liability insurance for small business helps owners prepare for the unexpected and focus on growing their companies without constant fear of financial loss.

Building a Tech-Driven Culture of Accountability

Beyond policies and software, a company’s culture plays a crucial role in how effectively it manages risk. A digitally aware and accountable workplace encourages everyone, from executives to interns, to take responsibility for their actions.

This can be achieved by:

- Recognizing and rewarding security-conscious behavior.

- Encouraging employees to report vulnerabilities without fear.

- Providing regular IT and compliance training.

- Leading by example in following data and security protocols.

When accountability becomes part of the company’s DNA, both human and technological risks are significantly reduced.

Learning from Real-World Examples

Small businesses have borne the brunt of these costly setbacks, with a better IT protection scheme having prevented such.

An example would be the local retailer that stored client information unencrypted and was fined after the breach. Another small business was saved from losing millions by ransomware, thanks to automated cloud backups implemented by its IT provider.

These cases show that leveraging the right IT services is not just a convenience; it is an essential liability management strategy.

Planning for the Future

Liability protection is not a one-time project; as companies grow, their risks evolve, and their protection strategies must adapt alongside their business and technology stack. A startup using basic cloud tools today might later need advanced cybersecurity, data compliance, or remote workforce solutions.

Regularly reviewing:

- IT infrastructure and vendor security,

- Insurance coverage, and

- Employee training programs

- keeps your protection strategy relevant and effective.

Conclusion

The risks unique to liability for small companies. They are different from large multinationals because they cannot just take the massive setbacks within the financial cushion. However, small business has the following risk reduction measures: utilizing IT services, creating strong internal policies, holding solid contracts, ensuring digital and physical security, and maintaining the correct insurance policies.

An appropriate balance between technology and strategy enables small businesses to innovate and grow, confident that their operations, data, and reputation will be protected.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

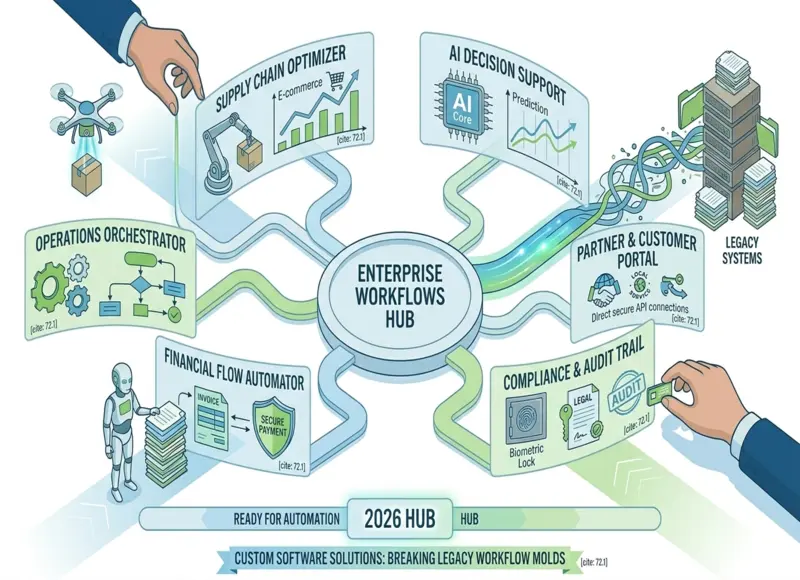

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127