Blockchain’s Role in Modern Forex Trading Automation

-

Last Updated:

31 Dec 2025

-

Read Time:

6 Min Read

-

Written By:

Elia Martell

Elia Martell

-

738

Table of Contents

Explore the growing role of blockchain in automated Forex trading, where smart contracts, transparency, and decentralized systems enhance speed, security, and trust while reshaping how global traders access markets and execute strategies across modern fin

When people hear the word blockchain, most immediately think of cryptocurrencies such as Bitcoin or Ethereum. While it is true that blockchain technology serves as the foundation of the crypto market, its potential extends far beyond digital currencies.

One of the most promising areas where blockchain can bring meaningful change is the foreign exchange market, commonly known as Forex. By combining blockchain technology with automated trading systems, the Forex industry has the opportunity to become faster, more transparent, more secure, and significantly more efficient.

As financial markets continue to evolve through digital transformation, blockchain is emerging as a powerful tool that can reshape how Forex trading operates. From trade execution to settlement processes, blockchain has the ability to remove inefficiencies that have existed for decades. When paired with automation, it creates an environment where trading can be smoother, safer, and more accessible to participants around the world.

The Current State of Automated Forex Trading

Forex trading robots have already brought major changes to the Forex market. Trading robots, often known as Expert Advisors or EAs, are now widely used by both individual traders and large institutions. These systems follow predefined rules and strategies, allowing trades to be executed automatically without constant human involvement.

The major critique of the potential of automatic trading is the absence of emotional decision-making. Fear, greed, overconfidence, and hesitation push human traders to make bad decisions. For example, too early exit from a trade or holding onto losing positions. On the contrary, the automated systems operate strictly in accordance with logical and pre-defined rules, maintaining consistency in trading behavior.

Another major benefit is the ability to trade continuously. Forex markets operate around the clock, and it is impossible for a human trader to monitor them at all times. Trading robots do not need sleep, breaks, or rest. They can analyze market movements and execute trades at any hour, ensuring that opportunities are not missed due to time limitations.

Automation has also lowered the barrier to entry for new traders. Individuals who may not have years of experience or deep technical knowledge can now participate in the Forex market by using prebuilt trading strategies. This has made Forex trading more accessible to a wider audience than ever before.

Yet, all these advantages are no guarantee for the abolition of all procedural lacunae. Absence of transparent markets, manipulation of data, and obsolete, slow trading execution-plus weak security technology, is the lay of the land for traders, indicating that advanced technology is needed to advance the possibilities of blockchain.

How Blockchain Improves Forex Trading

Blockchain is a type of distributed ledger technology that records information across a network of computers. Once data is added to the blockchain, it cannot be altered or deleted, making it highly secure and reliable. This characteristic makes blockchain particularly suitable for financial transactions, where trust and accuracy are essential.

When applied to Forex trading, blockchain can improve several key areas.

Faster Trade Execution

Traditional Forex systems have a few intermediaries like banks, clearing houses, and liquidity providers. Each one of them contributes an additional step in the transaction that eventually takes time to consummate. Often, they get quite expensive, especially during periods when the market is moving very rapidly.

Blockchain facilitates transactions directly between participants, and this eliminates middlemen in some cases. Smart contracts are so automated that the transaction is executed once the predefined conditions are satisfied. This has a lot to offer, like reduced execution periods and reduced chances of disputes or delays.

Lower Transaction Costs

By removing intermediaries from the trading process, blockchain helps reduce operational and transaction costs. Traders no longer need to pay high fees to multiple parties involved in clearing and settlement. As a result, more of the trader’s capital is preserved, making trading more cost-effective for both retail and institutional participants.

Greater Transparency And Security

Every transaction recorded on a blockchain is transparent and verifiable. Once data is added, it cannot be changed without the consensus of the network. This makes fraud, manipulation, and unauthorized activity extremely difficult. Traders can verify transaction histories and trust that the information they are seeing is accurate and reliable.

Simplified Global Access

The blockchain system operates 24/7 across time zones and without banking hours. This then allows for faster access to funds and markets at any time. Increased liquidity allows traders to immediately enter the market. Geography is no longer an issue for learning as traders operate across the world.

Blockchain and the Future of Expert Advisors

As blockchain technology becomes more widely adopted, its impact on Expert Advisors is expected to grow significantly. Trading algorithms depend heavily on accurate market data and fast execution. When data is delayed or manipulated, trading performance suffers.

Blockchain technology offers a solution to these problems through the supply of clear and trustworthy data. In the case of blockchain-backed systems, the verification of price data and trade performance not only cuts down the risk of brokers or other parties meddling but also makes it possible for the automated trading systems to work more effectively and with the strategies they were actually meant to use.

Smart contracts add another layer of efficiency. These self-executing contracts automatically carry out trades once predefined conditions are met. This reduces the need for manual intervention and minimizes the risk of human error. As a result, Expert Advisors can function with greater accuracy, consistency, and trustworthiness.

Challenges That Still Exist

Blockchain technology, a miracle, is still facing challenges despite its numerous advantages. One of the major hurdles is the uncertainty in regulation. It is a fact that all the governments and regulators globally are in the process of establishing rules and frameworks for the blockchain-based financial systems. The ambiguity that exists can lead to a slowing down of the adoption, and at the same time, traders and institutions will be left with an uncertain situation.

One more difficulty faced is the absence of uniformity among different blockchain networks. Integration without any problems could be a challenge, given the variety of different platforms with their respective capabilities and rules. This cutting up of the market complicates the way of creating trading systems that can be recognized and used by everyone.

Liquidity is also a concern. Traditional Forex markets handle enormous trading volumes every day. While blockchain-based platforms are growing, they have not yet reached the same level of liquidity. This can limit their attractiveness to large institutional investors.

Another crucial aspect is environmental concerns. A number of blockchain networks are dependent on consensus mechanisms that consume a lot of energy, which leads to the question of sustainability. On the contrary, new-generation blockchain technologies are under development with low-energy models that are almost completely non-polluting.

Conclusion

The impact of Blockchain on Forex Trading is considerable, not only in terms of speed but also transparency and security. Nonetheless, the difficulties remain, and the gradual resolution of the problems concerning scalability, regulation, and energy efficiency is the path taken.

As traders, brokers, and institutions continue to gain a deeper understanding of blockchain technology, confidence in its use will continue to grow. Over time, the integration of blockchain into Forex trading is likely to become more widespread and refined.

The future of Forex trading is not just automated. It is decentralized, transparent, and driven by blockchain innovation.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

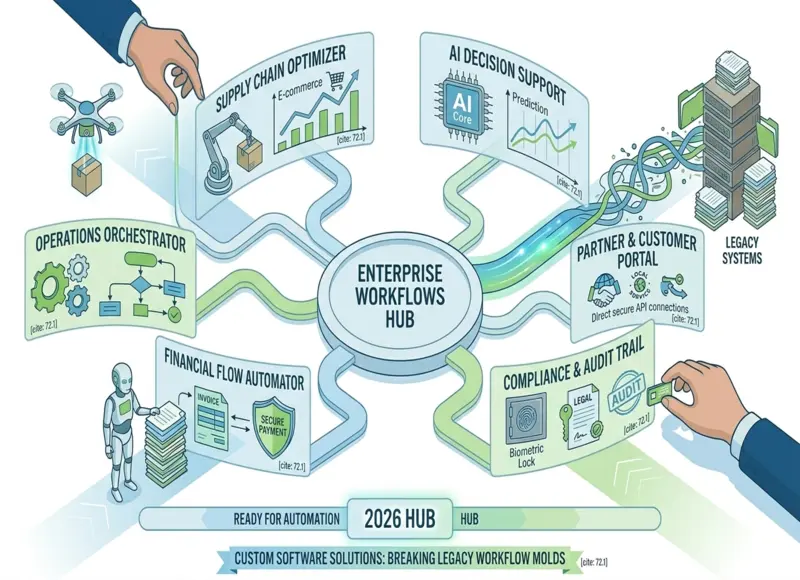

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127