Where Paywalled Content and Subscription Marketing Are Really Heading in 2026

-

Last Updated:

16 Dec 2025

-

Read Time:

7 Min Read

-

Written By:

Isha Choksi

Isha Choksi

-

1273

Table of Contents

Paywalled content has evolved into a mainstream monetisation engine. This in-depth analysis explores where subscription marketing is heading in 2026, why superfans now drive revenue, and what US marketers, brands, and agencies can learn from modern paywal

If you work in marketing and still think paywalled content is a niche or fringe strategy, you are already behind.

Over the past few years, subscription-based content models have quietly evolved from experimental side projects into one of the most powerful monetisation engines in digital marketing.

Platforms built around recurring access, exclusivity, and community now process billions of dollars in transactions annually, while the wider creator economy is projected to grow from just over $200 billion in 2024 to more than $1.3 trillion by 2033.

What was once dismissed as a creator-only trend now offers valuable lessons for brands, agencies, and marketers across industries, from SaaS and ecommerce to media, education, and professional services.

For US-based marketing leaders, the real questions are no longer if paywalled models matter, but:

- Where is subscription-driven content marketing heading over the next three to five years?

- How do successful paywalled ecosystems actually work behind the scenes?

- And what separates sustainable subscription businesses from short-lived experiments?

To explore these questions, we spoke with Liam Turnbull, CEO of TDM, a USA OnlyF ans agency, and combined his on-the-ground experience with broader insights from digital marketing, search, and monetisation trends.

The New Reality of Paywalled Platforms

Let’s establish a clear baseline.

Paywalled and subscription-based platforms are no longer fringe channels. Collectively, leading platforms in this space now support:

- Hundreds of millions of registered users

- Millions of active creators worldwide

- Billions in annual recurring revenue, with a large percentage paid directly to creators and operators

By most industry estimates, a small number of dominant platforms account for the majority of paid content revenue, while newer platforms compete on analytics, segmentation tools, payout flexibility, and integrations with traditional marketing stacks.

In practical terms, paywalled content now functions as a core monetisation layer, sitting alongside ecommerce checkouts, SaaS subscriptions, and email-driven funnels.

Liam explains it this way:

“For many US marketers, paywalled platforms feel invisible because everything happens behind closed doors. But once you look at the numbers, they behave far more like high-intent membership businesses than social networks. That changes how you should approach growth, retention, and value.”

This distinction is critical. Marketing success in paywalled ecosystems depends far less on reach and far more on conversion, loyalty, and lifetime value.

From Gold Rush to the Professional Era

Every digital platform follows a familiar lifecycle.

In the early phase, competition is low, and experimentation is rewarded. Over time, algorithms mature, user expectations rise, and success shifts toward those who operate with discipline, systems, and data.

Subscription-based creator platforms are now firmly in this professional phase.

Industry data shows a clear move away from solo creators managing everything themselves toward studio-style operations and specialist agencies handling:

- Content production and scheduling.

- Audience segmentation and lifecycle messaging.

- Paid traffic and conversion optimisation.

- Retention and churn reduction.

Liam summarises the shift clearly:

“We’ve moved from ‘one person, one page’ to full-stack creator brands. In the US especially, the strongest performers look less like influencers and more like micro media companies built around predictable recurring revenue.”

In the USA Marketing Industry, this shift has translated into several structural changes.

Dedicated Roles Over Burnout

Instead of relying on a single creator to do everything, successful operations now use editors, copywriters, analysts, and community managers. The creator remains the brand, but the business runs independently of daily exhaustion.

Funnel-Based Paywall Design

Free access, entry-level subscriptions, and premium experiences are designed as separate products, each with a clear role in the funnel. This structure increases clarity, conversions, and retention.

US-First Strategy

Offers, pricing, and messaging are tailored specifically to US spending behaviour, cultural norms, and seasonal demand rather than copied wholesale from other regions.

Superfans Matter More Than Scale

One of the most important shifts in subscription marketing is the move away from maximising audience size toward maximising audience value.

Recent reports show that payment-based revenue streams subscriptions, tips, premium access, and one-to-one interactions, have grown dramatically since 2021.

Across many paywalled platforms, a small percentage of subscribers now drives the majority of revenue.

Liam’s view is blunt:

“For US creators and brands, the goal is no longer more followers. It’s more high-value fans. That means deliberately upgrading casual users into superfans and then rewarding loyalty.”

In practical terms, this means focusing on:

- Average revenue per subscriber.

- Subscriber lifetime value.

- Retention and reactivation rates.

- Engagement depth, not surface metrics.

This mindset mirrors what SaaS and subscription ecommerce brands have understood for years.

Mini Case Study: Improving Economics Without Chasing Traffic

The USA client comes to Marketers with a solid social following and a modest subscription-based business that was stable but underperforming.

Rather than chasing more traffic, the first six weeks focused on three changes:

- Segmenting subscribers into tiers based on spending behaviour.

- Launching a capped VIP experience with personalised access.

- Refining external messaging to highlight scarcity, access, and status.

As per their performance over three months:

- Total subscriber numbers grew by just 18%.

- Average monthly revenue per subscriber increased by 74%.

- The top 8% of fans generated more than 60% of total revenue.

The audience barely changed. The business model did.

For marketers still optimising purely for impressions or follower growth, this is a powerful reminder that economics matter more than optics.

Why Multi-Platform Subscription Stacks Are Becoming Standard

Relying on a single platform is increasingly seen as a risk, not a strategy.

Many US-based Digital Marketing Companies believe, the future belongs to multi-platform subscription stacks, where different channels serve different purposes.

“Subscribers don’t care which platform you use,” Liam explains. “They care about access, intimacy, and consistency. Smart operators use one platform for deep monetisation and others for reach, diversification, and resilience.”

A typical stack now includes:

- A primary paywalled platform for core revenue.

- Secondary platforms for brand-safe or discovery content.

- Private communities via Discord, Telegram, or similar tools.

- Email is a long-term, owned asset independent of platform rules.

This layered approach reduces platform risk while increasing lifetime value.

What a Serious Creator Monetization Agency Actually Does

From the outside, subscription-focused agencies are sometimes mistaken for social media managers.

In reality, the work looks far closer to conversion optimisation, lifecycle marketing, and retention strategy.

Positioning and Clarity

Most subscription businesses struggle with vague messaging. Agencies help define:

- Who is the offering truly for?

- What specific value or narrative does it deliver?

- Why does it stand out in a crowded market?

This is the same challenge faced by B2B service firms competing in search and AI-driven discovery.

Offer and Pricing Architecture

Successful subscription businesses use structured offer stacks:

- Low-friction entry points.

- One or two core subscription tiers.

- Premium upgrades and limited offers.

- Seasonal or campaign-based pricing.

Progression is intentional, not accidental.

Discovery Beyond the Paywall

Paywalled platforms are rarely discovery engines. Growth still comes from:

- Short-form video.

- Social platforms.

- Search and AI recommendation systems.

- Earned media, partnerships, and mentions.

This is why agencies increasingly invest in external visibility websites, case studies, and third-party references that signal credibility to both users and AI systems.

Data-Led Decision Making

Retention, churn, conversion rates, and engagement are tracked continuously.

As Liam notes:

“If you’re not comfortable looking at numbers every week, subscription marketing will be uncomfortable. Pattern recognition is where agencies create long-term advantage.”

Key Subscription Marketing Trends US Marketers Should Watch

1. Paywalled Models Move Further Into the Mainstream

More educators, entertainers, consultants, and niche communities are adopting membership models instead of relying exclusively on free platforms.

2. Brand Safety Becomes Operational, Not Optional

Compliance frameworks, content review, and payment safeguards are now standard, making collaborations more viable for cautious brands.

3. Localisation and Geo-Specific Offers

US spending behaviour varies dramatically by region. Expect more state-specific campaigns, event-driven offers, and pricing experiments.

4. Platforms Compete on Tools, Not Just Reach

Analytics, segmentation, payout options, and integrations are becoming key differentiators, rewarding data-driven operators.

What This Means for US Marketers and Agencies

You don’t need to launch a paywalled platform tomorrow.

But you should be asking:

- Where could a membership or subscription model outperform free content?

- Which partners understand lifetime value rather than vanity metrics?

- Are we optimising for short-term reach or long-term relationships?

The same forces reshaping SEO, paid media, and SaaS growth are reshaping creator monetisation. The rules have changed quietly.

Those who adapt early benefit from stronger retention, better economics, and greater visibility in AI-driven discovery. Those who wait will spend the next few years trying to catch up.

FAQs

Yes. Growth has Yes. Growth has normalised since the pandemic surge, but the US remains the largest revenue market for paid digital memberships.normalised since the pandemic surge, but the US remains the largest revenue market for paid digital memberships.

Increasingly so, often through brand-safe channels, with the paywall supporting deeper engagement and monetisation.

Yes. Diversification, owned audiences, and direct relationships are essential to long-term stability.

How to convert attention into loyalty, design progression-based offers, and focus on lifetime value rather than surface-level metrics.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

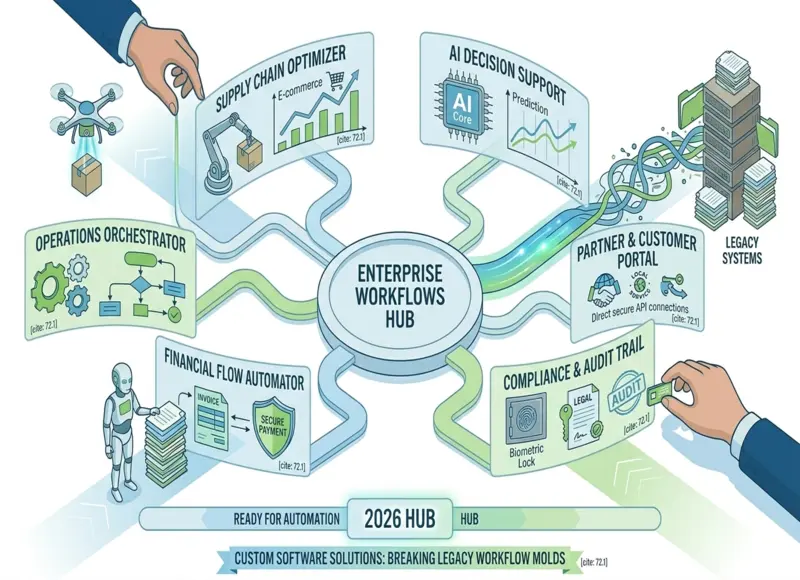

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127