Table of Contents

Looking for seamless transactions? Our website guides startups in navigating payment gateway integration for a smooth experience.

?

For any startup, the focus is often on developing a stellar product, crafting a compelling marketing strategy, and providing excellent customer service. However, an oft-overlooked aspect that is equally paramount is the payment process. Payment gateway integration services are at the core of any e-commerce or online service startup as they facilitate seamless money transactions between customers and the business. To thrive in the competitive marketplace, startups must provide customers with reliable, secure, and efficient payment options.

The Vital Role of Payment Gateway Integration Services

Payment gateways are crucial intermediaries that OK-fine a handshake between various financial entities, customer bank accounts, and the merchant account associated with the startup. Integrating these services is not merely about accepting payments but also about building trust with your customers.

Gateways are selected based on many factors, including transaction fees, payment methods accepted, integration capability with your current systems, and security standards. Choosing a payment gateway for a startup could significantly influence customer satisfaction and the overall transaction experience.

Understanding Your Business Needs

Before considering the plethora of payment gateway integration services, startups must determine their needs. The assessment should include things like:

- Type of transactions: Are they one-time or recurring?

- Volume of transactions: How many transactions are anticipated?

- International transactions: Will you be accepting payments from outside your home country?

- Industry compliance: Does your industry have specific payment processing regulations?

This initial step will inform you which payment gateway providers align with your startup's transactional needs and allow you to conduct a more targeted search.

Evaluating Payment Gateway Providers

When it comes to evaluating potential providers, here are some aspects to consider:

- Compatibility: Ensure the gateway integrates well with your current setup, website, and accounting software.

- Security: Look for providers that comply with the Payment Card Industry Data Security Standard (PCI DSS) to safeguard sensitive data.

- User Experience: Select gateways that offer customers a smooth and straightforward payment process.

- Customer Support: Access to reliable support is critical in solving payment issues quickly to maintain customer satisfaction.

- Cost: Fee structures vary widely, and startups should analyze the fee breakdown carefully to prevent unexpected costs.

Picking the Right Integration Type

Payment gateway integration comes in different forms, and each method comes with its own set of considerations:

- Hosted Payment Gateways: These redirect users away from your site to the payment service provider’s page to complete the transaction. They're very secure but might disrupt the user experience.

- Integrated Gateways: These use APIs to process payments directly on your site, providing a seamless customer experience but may require a more rigorous security measure on your part.

- Direct Post Methods: This option also keeps the customers on your site but posts data directly to the gateway provider, offering a balance between user experience and security.

When choosing the integration type best suits your startup's needs, consider the trade-offs between control, security, and user experience.

Security: A Non-Negotiable Factor

The importance of security in payment gateway integration cannot be overstated. A breach can impact your financial bottom line and irreparably damage your startup's reputation. When securing transactions, ask prospective gateway providers about their encryption standards, fraud detection capabilities, and protocols for security breaches.

In addition, compliance with industry standards such as PCI DSS and SSL encryption are non-negotiable features a payment gateway should offer. Moreover, tokenization and real-time processing can further enhance the safety of each transaction.

The Importance of User Experience

Integrating a payment gateway should always maintain the user experience. Startups must ensure that the journey from cart to completion is fluid, intuitive, and as frictionless as possible. A complex or extended payment process can deter potential conversions and lead to abandoned carts. The goal should be a gateway that complements and enhances the startup's platform's overall user interface and design.

Streamlined Checkout Process

A streamlined checkout process directly impacts conversion rates. The fewer steps and inputs required from the user, the better.One way to achieve this is to create payment page that’s optimized for speed and simplicity, reducing friction at the final step of the buyer’s journey.Another option, like one-click purchasing and the ability to save payment information for future use, can make a big difference.Additionally, ensuring that your payment gateway is mobile-friendly is critical, as many transactions are made on smartphones and tablets.

Technical Support and Development Resources

Startups will likely encounter technical challenges during and after integration. When choosing a payment gateway provider, check the availability of technical support and development resources. The ideal provider should offer thorough documentation, SDKs for different programming languages, and responsive customer service.

Preparing for Future Growth

A startup should anticipate not just current needs but future growth as well. Scalability is a crucial factor in choosing a payment gateway. As the business grows, there will be new requirements, including:

- New Payment Methods: Offering new forms of payment to keep up with market trends.

- Increased Transaction Volume: The gateway should be able to handle growth in transaction numbers without hiccups.

- Geographic Expansion: Startups must ensure their gateway can adapt to new markets if they plan to expand internationally.

In conclusion, choosing a payment gateway integration service for your startup is a multifaceted decision that impacts many aspects of your business. Startups must conduct thorough due diligence to understand their needs, evaluate their options, and pick a gateway that provides a secure, scalable, and customer-centric payment process. With proper integration, startups can offer seamless transactions and build the foundation for a trusted and enduring relationship with their customers.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

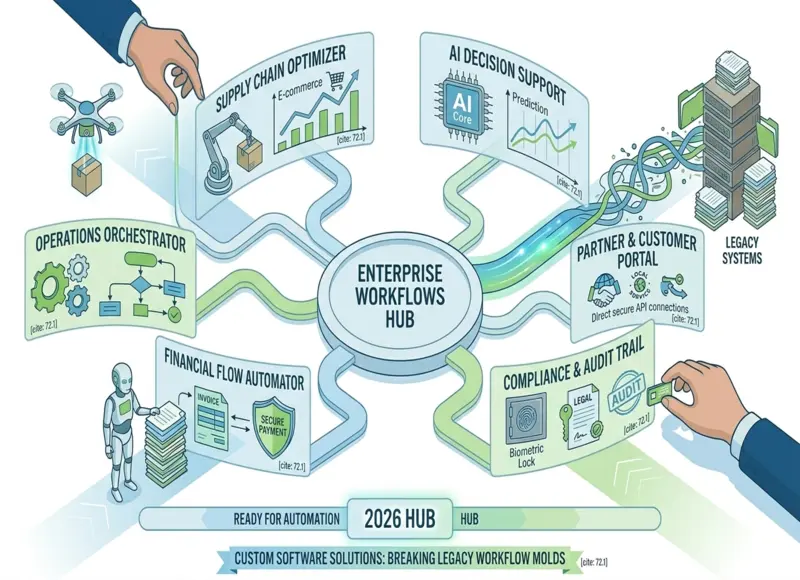

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127