Lending KPIs to Measure the Success of Your Finance Business

-

Last Updated:

23 Jan 2026

-

Read Time:

9 Min Read

-

Written By:

Isha Choksi

Isha Choksi

-

575

Table of Contents

A practical guide to lending KPIs that go beyond surface-level metrics. Learn how to track growth, risk, profitability, operations, and customer outcomes to improve lending performance and decision-making.

Lending performance rarely improves because a team “watches the numbers.” It improves when the numbers answer specific operational questions. Which borrowers drive losses. Which channels produce durable repayment. Which products keep margin after funding costs and servicing time. A tight KPI set turns that uncertainty into weekly decisions that compound.

Modern teams also measure lending with more granular data than a general ledger can provide. Many analytics stacks blend loan-system data, bank feeds, and operational events, including Snowflake cashflow data, to connect repayment behavior to underwriting assumptions and day-to-day execution. Used carefully, those signals help leaders spot risk earlier and run tighter operations without overreacting to noise.

Start With a KPI System That Matches How Lending Works

A useful KPI system separates three layers: growth, risk, and profitability. Then it adds two “control” layers: operations and customer outcomes. This matters because a business can look healthy on one layer while failing on another. Fast origination growth can hide rising early delinquency. A strong margin can hide rising complaints and repurchases.

Build your scorecard with both leading and lagging measures. Lagging KPIs confirm what already happened, like net charge-offs and return on assets. Leading KPIs warn you early, like roll-rates, first-payment default, or funding line utilization. Use both, and decide who owns each one.

Segment everything. A blended portfolio number can mislead. Track by product, channel, geography, term, credit tier, and vintage. When you do that, you can act with precision instead of tightening the whole credit box.

Origination Quality KPIs That Go Beyond Volume

Volume matters, but volume alone can hurt a lender. Track originations with a quality lens.

Start with the application-to-book rate and pull-through rate. These show how efficiently your funnel converts, plus how often borrowers drop after an offer. Then track approval rate by credit tier and channel. A sudden approval spike can signal model drift or weaker fraud controls. A sudden drop can signal overly strict policies or broken data inputs.

Add “early performance” KPIs to each vintage. Look at 30-day delinquency within the first three months, payment shortfalls, and utilization patterns for revolving products. Those early signals often correlate with later losses, so they give your credit team time to adjust before charge-offs rise.

Finally, watch concentration. Set limits for single industries, employers, regions, or collateral types. Concentration does not cause losses on its own, but it turns a macro shock into a portfolio event.

Delinquency and Roll-Rate KPIs That Predict Trouble Early

Delinquency measures stress before charge-offs hit. Many institutions define delinquent loans as those past due 30 days or more and still accruing interest, plus those in nonaccrual status. Track delinquency in buckets: 1 to 29, 30 to 59, 60 to 89, and 90+ days past due. Each bucket tells a different story about borrower behavior and collection effectiveness.

Roll-rates make delinquency actionable. A roll-rate shows the percentage of accounts that “roll” from one bucket to the next over a period. If 30 to 59 rolls into 60 to 89 faster than normal, collections scripts, contact timing, or hardship options may need adjustment. If early buckets swell but roll-rates stay stable, you may have a temporary shock or a servicing issue like payment processing delays.

Use cohort charts for each monthly vintage. A healthy portfolio shows a consistent shape. A weak vintage shows early bulges that persist. That visual makes credit discussions faster and more honest.

Net Charge-Off and Loss KPIs That Define Credit Performance

Charge-offs are the point where losses become real. Track gross charge-off rate, recovery rate, and net charge-off rate. Break them out by product and vintage.

Add loss severity metrics that help you diagnose root causes. Loss given default (LGD) and recovery timing matter for cash planning. For secured lending, track collateral liquidation timeline and recovery variance. For unsecured lending, track settlement rates and recovery per collector hour. For small-business lending, separate business failure losses from fraud losses. They require different controls.

Also track nonperforming exposures (NPE) or nonperforming loan (NPL) measures if your reporting framework uses them. Basel guidance supports consistent identification of nonperforming exposures across supervisory contexts. Even if you do not report under Basel rules, the concept helps: monitor 90+ days past due and “unlikely-to-pay” flags as a pipeline of future losses.

Provisioning and Reserve Adequacy KPIs That Protect the Balance Sheet

Losses do not surprise healthy lenders. They get priced, reserved, and monitored. Under CECL, the allowance for credit losses is a valuation account that adjusts the amortized cost of a financial asset to present the net amount expected to be collected. That definition implies a discipline: reserves should move with expected credit outcomes, not with headlines.

Track allowance for credit losses (ACL) as a percentage of loans, then track ACL coverage of noncurrent or 90+ day loans. If coverage falls while delinquency rises, the portfolio may carry more risk than reserves reflect, or modeling assumptions may lag reality.

Add a “reserve responsiveness” KPI: how quickly reserves react to meaningful shifts in delinquency, unemployment, or portfolio mix. You want a stable framework, not a twitchy one. Too slow creates shocks. Too fast can create earnings volatility that does not match underlying risk.

Yield, Margin, and Risk-Adjusted Profitability KPIs

Revenue in lending looks simple until costs show up. Track portfolio yield and net interest income by product. Then track net interest margin (NIM). The OCC notes that NIM measures the profitability of a bank’s primary activities and supports analysis of performance and risk drivers. Even outside traditional banking, the same logic holds: margin quality matters more than stated APR.

Add risk-adjusted margin. A product with high yield and high losses can deliver worse economics than a lower-yield product with stable repayment. One practical approach is to calculate contribution margin per loan: interest and fee income minus funding costs, expected losses, servicing costs, and acquisition costs. Track it by channel and credit tier.

Include fee yield, but keep it transparent. Fee income can improve unit economics, yet it can also trigger complaints and regulatory attention if it feels unclear to borrowers. When you measure fees, measure outcomes too.

Funding Cost And Liquidity KPIs That Decide Real Growth Capacity

Growth requires funding. Track cost of funds by source: deposits, warehouse lines, securitizations, whole-loan sales, or partner programs. Track the weighted average cost and the variability of that cost across rate cycles. If your funding cost rises faster than your asset yield adjusts, your margin compresses quickly.

Monitor liquidity with operational KPIs, not only treasury ratios. Track unused committed funding capacity, utilization rates, and time-to-fund. A lender can have strong demand and still miss growth targets because funding cannot keep up with disbursement timing.

If you operate in a bank context, also track peer indicators from public data. Use benchmarks as context, not as targets. Your product mix and funding model may differ.

Customer Acquisition And Unit Economics KPIs For Sustainable Lending

Acquisition KPIs matter because weak acquisition discipline can produce growth that never pays back. Track customer acquisition cost (CAC) by channel, then track conversion to booked loans and conversion to “performing loans.” A booked loan that goes delinquent early can represent negative value.

Pair CAC with the payback period. Payback should reflect net cash contribution, not revenue. For installment loans, estimate cash contribution by month after funding costs, losses, and servicing. For revolving products, estimate by utilization and payment behavior.

Then track lifetime value (LTV) with caution. LTV models can become fantasy if they assume refinance rates or repeat borrowing that do not persist in stressed periods. Use LTV as a planning tool and validate it with cohort reality. Cohort-based LTV forces honesty because it anchors estimates in observed behavior.

Operational Efficiency KPIs That Turn Strategy Into Execution

Operations decide if a credit strategy scales. Track time-to-decision, time-to-fund, and percent of applications that flow straight through without manual touches. Every manual touch costs money and introduces inconsistency.

Measure cost per booked loan and cost per active account. Tie those costs to cycle time. If costs rise, ask if they rise because volumes fall, because manual review increases, or because servicing gets harder due to delinquency. Different causes require different fixes.

In regulated banking, many leaders track the efficiency ratio. FDIC defines efficiency ratio as noninterest expense as a share of net operating revenue. Even if you do not report that ratio formally, you can use the same concept to evaluate how well revenue supports operating costs. The key is granularity. A single ratio is less useful than cost drivers by function.

Collections and Servicing KPIs That Protect Cash Flow

Collections performance shows up in cash before it shows up in accounting. Track right-party contact rate, promise-to-pay kept rate, cure rate by delinquency bucket, and time-to-cure. Track repayment plan success and hardship plan success. Those measures matter for both losses and customer outcomes.

Add first-payment default (FPD) as a top-tier KPI. FPD often signals fraud, weak verification, or poor underwriting fit. It can rise quickly and tend to predict future deterioration if it stems from policy gaps rather than a one-time shock.

Measure dispute and refund rates, too. High dispute rates can signal poor communication, confusing fees, or merchant issues in embedded-lending contexts. They also consume staff time and create a risk.

Credit Model and Data Quality KPIs That Keep Decisions Stable

AI and analytics can improve underwriting, but only when teams measure model health. Track population stability index (PSI) or similar drift metrics for key features. Track approval rate shifts by segment. Track calibration of predicted probability of default versus observed delinquency. A model can maintain a high AUC while still mispricing risk if calibration drifts.

Create “data freshness” KPIs. How often do you receive bank transaction updates. How often does employment data refresh. How often do fraud signals arrive. A model that uses stale features behaves like a weaker model, even if the algorithm is strong.

Also track override rates and override outcomes. Overrides happen in every lending operation. The KPI should focus on learning: do overrides improve performance, or do they introduce bias and losses.

Customer Outcomes, Complaints, and Conduct KPIs

Neutral, data-backed management includes customer outcomes. Track complaint volume per 1,000 accounts, complaint themes, and resolution times. The CFPB Consumer Complaint Database provides a public way to view complaint trends and company responses in financial products and services. Even if you do not benchmark directly to that dataset, it reinforces a useful practice: treat complaint categories as leading indicators, not PR events.

Measure clarity KPIs. For example, track how often borrowers contact support after disclosure delivery, how often they ask for payoff quotes, and how often they dispute fees. Those contacts can signal friction in the product experience. They can also signal compliance risk.

Pair customer KPIs with credit KPIs. A collections strategy can improve short-term cash and still harm long-term outcomes if it drives complaints and churn. A balanced scorecard keeps leadership from optimizing one area at the expense of another.

Turning KPIs Into a Working Cadence

KPIs create value when they drive action. Build a weekly operating rhythm: a credit review, an operations review, and a unit-economics review. Assign owners, set thresholds, and define “next actions” in advance. When a KPI crosses a threshold, the team should already know what to test.

Keep the scorecard short. Ten KPIs that get used beat fifty KPIs that get ignored. Still, keep drill-down capability ready. The scorecard should point to root causes, not bury them.

Finally, document decisions and outcomes. When you tighten a credit policy, record the expected impact. Then measure the actual impact by cohort. That feedback loop turns KPI tracking into institutional learning, which is what drives long-run lending performance.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

136

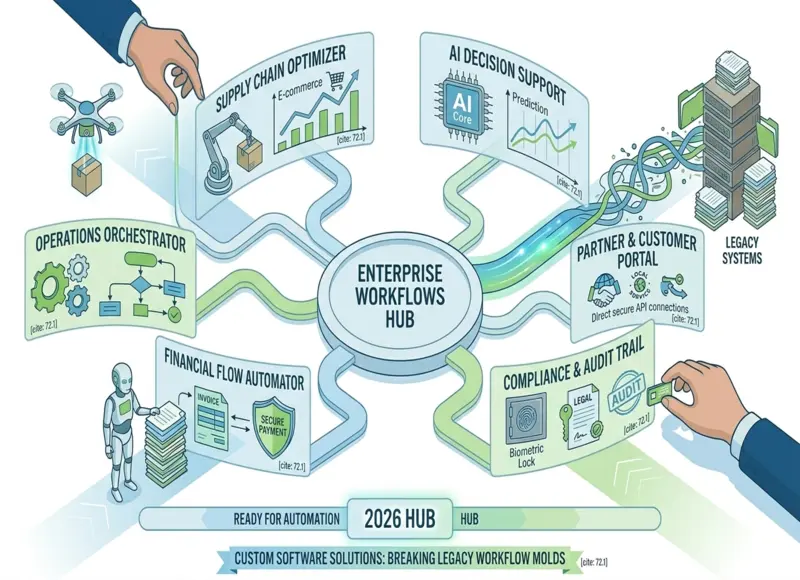

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

164