Table of Contents

5 key advantages fintech platforms offer over traditional trading systems, including lower fees and real-time access.

Fintech platforms have transformed how people and businesses manage money, invest, and handle transactions in the financial industry. From banking and e-commerce to online payments and money management, the development of fintech startups and platforms has impacted various industries.

The fintech revolution has transformed online trading, with brokerage firms and platforms adopting new features. Alternative trading and investment platforms are also gaining a share of the market. But how different are fintech platforms from legacy trading systems, and what advantages can they have?

- To answer this question, we must look at a few features and how fintech platforms stack up against older trading systems.

User-Friendly Interface

Fintech platforms are typically user-centric, meaning they are designed with maximum efficiency and navigability in mind, making them more convenient for the end user. Conversely, legacy trading systems can sometimes be clunky and visually unappealing, so they must work on new fintech platforms' slick and modern designs.

For example, MetaTrader 4 is one legacy trading platform that can be compared to modern fintech platforms. While MT4 has ample functionality, fintech platforms are easy to use and quite beginner-friendly, giving them the edge for contemporary users. Furthermore, most modern fintech solutions also offer mobile apps for iOS and Android devices, which is only sometimes valid for older trading systems.

Focus on Different Markets

Most legacy systems are geared towards a particular asset class, such as forex or stocks. Conversely, many fintech companies offer a mix of different instruments without losing functionality and essential features required for traders. This difference becomes apparent when we analyse the currency market compared to the stock market, as the use of leverage is considerably different between these two markets.

However, fintech platforms are often able to strike a balance between the design side of their offerings and the technical tools required for traders, such as any of the numerous indicators to assess the markets. Some platforms focus on stock trading while allowing traders to hold balances in multiple currencies and exchange funds without leaving the platform.

Data-driven Insights

A major advantage of modern fintech platforms is their ability to provide vast amounts of data to their clients, which includes anything from performance analysis tools and trade history to trading patterns and trade alerts. Therefore, traders have access to more advanced software when using new fintech software, while legacy software may lack some of the quality-of-life updates that come built-in in newer releases.

Customisation is another important advantage of newer software, which allows traders to create their own indicators, use adjustable price charts, and much more. This makes the process of trading more personalised - giving traders more autonomy over their strategies.

Innovative Financial Products

Innovation is an integral part of any fintech solution, which may take many different forms, from new and advanced features to ease of navigation, customizability, and more. In certain cases, fintech platforms that are focused on securities trading and investing may offer alternative investment vehicles to clients. This may include asset classes divided into shares, such as fine wines, precious metals, collectables, real estate, etc.

Most old trading platforms, including stocks, bonds, currencies, and commodities, are designed for exchange-listed assets. For this reason, users who sign up on fintech platforms may have access to instruments that are otherwise unavailable in traditional trading systems.

Lower Costs and Ease of Access

Modern fintech platforms are easily accessible to inexperienced users, thanks to a more simplistic interface and lower costs. In many cases, fintech platforms are available as free mobile and desktop applications, with commissions being the primary revenue source for the companies.

Due to their complexity and lack of user-friendliness, traditional trading systems like MetaTrader 4 may be harder for beginners to learn. Alternatively, some fintech platforms also operate on a subscription basis, which streamlines the costs associated with using the software.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

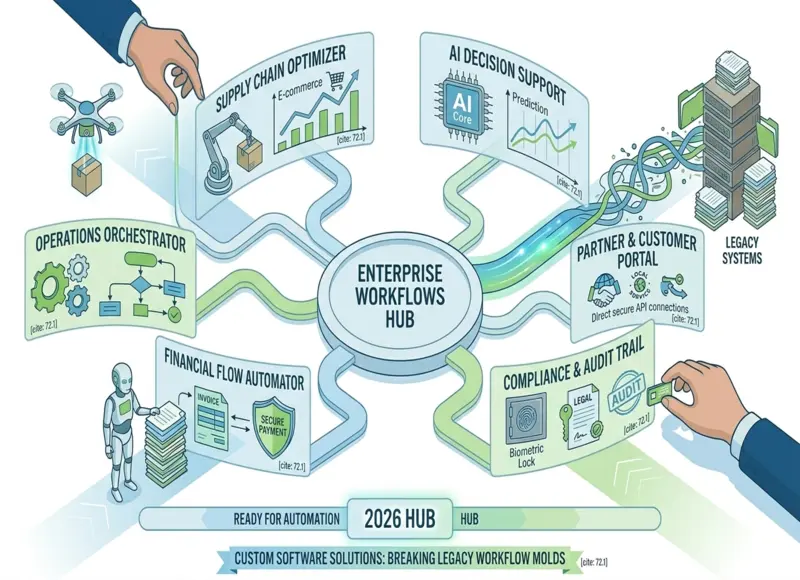

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127