Table of Contents

Conducting due diligence is a critical step in any investment or acquisition. This comprehensive checklist covers all the essential areas you need to consider.

Commercial due diligence is a comprehensive review of a business you are considering buying. It can help you make better-informed decisions about whether or not to buy the business, what value it has, and if any risks are involved. Conducting thorough due diligence ensures your investment is sound and aligned with your strategic goals.

In this ultimate guide, we will explore the key elements that should be included in a comprehensive commercial due diligence checklist. By following this guide, investors and acquirers can confidently navigate the due diligence process and gain valuable insights into the business they are considering.

1. Competitive Landscape

Understanding the competitive landscape is vital in evaluating the market dynamics and the positioning of the target business. A commercial due diligence checklist should include a detailed analysis of direct and indirect competitors.

It's not just about identifying your direct competitors but also comprehending their strengths and weaknesses. By conducting a thorough competitive analysis, you can gain a deeper understanding of the market dynamics and identify potential opportunities for growth and differentiation.

In addition to evaluating direct competitors, keeping a pulse on what other businesses are doing in your industry and how they are doing it is essential. The business landscape constantly evolves, and staying informed about emerging technologies, innovative strategies, and industry trends can provide a competitive advantage.

For instance, if you discover that a competitor is leveraging a new technology that you haven't considered yet, it's worth exploring the possibility of incorporating it into your own business model to stay ahead of the curve.

2. Customers

One of the key factors determining a business's success is its customer base. When considering the acquisition of a business, it's crucial to evaluate the quality and stability of its customer relationships. A commercial due diligence checklist should include a thorough assessment of customer satisfaction and retention rates and an analysis of referral patterns. Positive customer feedback and a high rate of referrals indicate a solid customer base and a strong brand reputation.

Engaging directly with current clients is essential to gain deeper insights into the customer experience. By talking with customers, you can gather valuable feedback and understand what customers appreciate about working with the brand.

Inquire about their overall satisfaction, the value they derive from the products or services, and any issues they may have encountered. This firsthand information will provide valuable insights into the quality of customer service quality and help you determine the viability of the potential acquisition.

In addition to evaluating customer satisfaction, it's essential to analyze the complaint history and customer churn rate. By understanding the reasons behind customer complaints and identifying the factors that contribute to customer attrition, you can assess the risks associated with the business and develop strategies to mitigate them.

3. Sales and Marketing

The sales and marketing section of the due diligence checklist is critical in evaluating the effectiveness of the business's revenue generation strategies. This section helps identify key stakeholders involved in the sales and marketing processes and provides insights into the systems and processes used to manage leads and close sales.

A key aspect to consider is the presence of a clear lead-generation strategy. A strong lead generation strategy is essential for acquiring new customers in an increasingly competitive marketplace. Evaluate the effectiveness of the lead generation processes, the channels used to attract leads, and the conversion rates at each sales funnel stage.

A user-friendly funnel software such as ClickFunnels can help you increase your conversion rates exponentially. You can have a sales funnel with many customization options with just a few clicks.

Consider whether the business leverages digital marketing, social media, content marketing, or other strategies to reach and engage its target audience.

Assessing the effectiveness of the marketing initiatives is equally important. Analyze the brand's positioning, digital presence, and overall marketing strategy. Review the effectiveness of marketing campaigns, the channels used for promotion, and the alignment of marketing efforts with the target market. A robust sales and marketing strategy will contribute to sustained growth and customer acquisition.

4. Company's Business Plan Review

Evaluating the feasibility and profitability of the company's business plan is a crucial step in the due diligence process. A comprehensive business plan review should assess the market potential, available resources, and business financial projections.

Start by evaluating the market for the product or service offered by the company. Is there a demand for it? Is the target market growing or saturated? Understanding the market dynamics and the growth potential is essential in determining the viability of the business plan.

Next, assess the company's resources and capabilities. Determine if the business has sufficient resources to launch and sustain its operations successfully. Consider factors such as financial resources, human capital, infrastructure, and technology.

Evaluate the financial projections provided in the business plan. Assess the accuracy and reasonableness of the projections and identify any potential risks or assumptions. Analyze the company's historical financial performance and cash flow generation capacity to assess its financial stability and growth potential.

5. Market Size of the Company

The company's market size is critical in assessing its investment potential. A company with a large market share and strong growth prospects will be more attractive to investors than one with a limited market presence and limited growth opportunities. Investors seeking comprehensive insights into such potential might find valuable guidance in a thorough power gauge report review, particularly one that offers stock recommendations, bonus reports, and a stock rating tool among its features.

Consider both the current market size and the projected growth of the industry. Analyze the market trends, customer behavior, and the competitive landscape. Evaluate the demand for the company's products or services and the potential for market expansion.

Additionally, assess the level of competition in the industry. Identify major competitors and evaluate their market position and strategies. Understanding the competitive dynamics will help you determine the company's competitive advantage and potential risks.

Conclusion

Remember that due diligence is a thorough and ongoing process. It cannot be completed in a single day. By following a comprehensive commercial due diligence checklist that includes evaluating the competitive landscape, assessing customer relationships, analyzing sales and marketing strategies, reviewing the business plan, and considering the market size, investors and acquirers can confidently make informed decisions and navigate the acquisition process.

By conducting diligent research and analysis, you can identify opportunities, mitigate risks, and position yourself for success in your investment endeavors.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

136

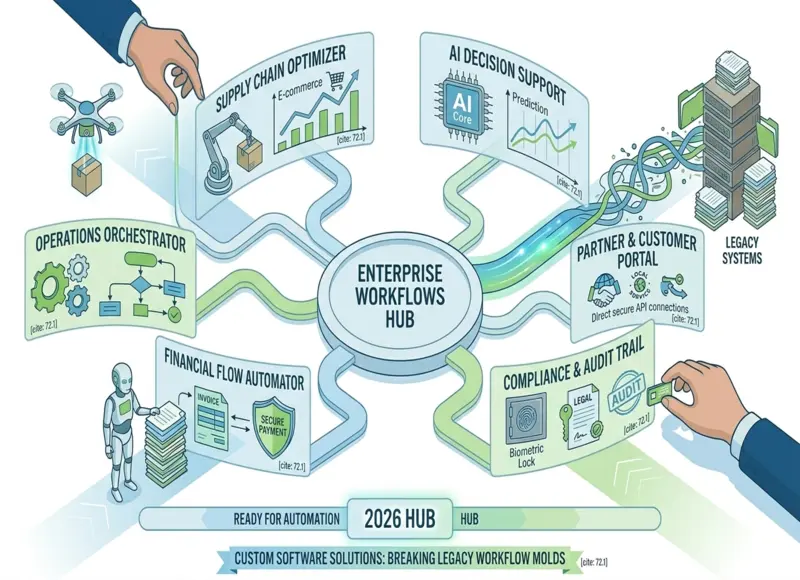

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

164