Are Financial Advisor Fees Worth It?

-

Last Updated:

07 Nov 2025

-

Read Time:

15 Min Read

-

Written By:

Harshita Toplani

Harshita Toplani

-

1442

Table of Contents

Financial advisor fees often raise one big question — are they really worth it? This in-depth guide explains what financial advisors do, how much they charge, and how to decide whether to hire one or manage your investments yourself.

Are you one of those who search on the internet for questions like “Do I need a financial advisor if I only have $50k?” or “Can a financial advisor help me save for my child’s college?” Many also wonder, “How much do financial advisor fees cost, and are they really worth it?”

You’re not alone. From young investors just starting out to retirees managing complex portfolios, people everywhere are asking if paying financial advisor fees makes sense.

At the center of this debate is one big question: Are financial advisor fees worth it? In this guide, we’ll cover what financial advisors actually do, how much they charge, the rise of DIY investing vs. professional management, red flags to watch out for, and how to decide if hiring one is right for you.

What Do Financial Advisors Do?

Financial advisors are like the human “Tinders” of finance. They match the right investments with the right clients to build relationships that last. The goal of the best financial advisors is not just picking stocks but creating strategies that keep clients satisfied with long-term portfolio growth.

Their responsibilities go far beyond investment selection.

- Investment management: Building and rebalancing portfolios.

- Retirement planning: Ensuring your savings can support your lifestyle.

- Wealth management: Tax planning, estate planning, and risk management.

- Financial planning: Budgeting, insurance, and setting financial goals.

Financial advisors are not just for the wealthy. They provide plans for people who want to achieve stability, protect wealth, and grow their money over time. In the U.S., millennials are the most focused on financial stability, with 44 percent ranking it as their top priority.

Are Financial Advisors Worth Hiring?

Hiring a financial advisor is more than just getting stock recommendations. A professional advisor helps with financial planning to create a clear path toward your goals. They can help you manage your money in the long term.

Working with one of the best financial advisors gives you access to strategies for retirement, tax efficiency, and building wealth. They also provide behavioral coaching to help you avoid emotional mistakes, such as panic-selling. This guidance can make a real difference in reaching your financial goals, with many portfolios improving by 3 percent or more per year, largely due to disciplined decision-making and smart tax planning.

Financial advisor charges are an expense, but the value often outweighs the cost. With expert advice and structured planning, you can make smarter decisions and grow your wealth more effectively than managing everything on your own.

Here are five benefits of hiring a financial advisor:

- Personal Financial Plan: They create a plan that matches your goals and situation.

- Retirement Planning: They help make sure your savings last through retirement.

- Tax Help: They guide you to reduce taxes and keep more of your money.

- Behavioral Support: They help you avoid emotional investment mistakes.

- Professional Expertise: They provide knowledge and strategies you can’t easily do on your own.

Whether you’re saving for retirement, your child’s future, or building wealth, a financial advisor can help. A trusted wealth management expert offers guidance and peace of mind that make their fees worthwhile.

How Much Do Financial Advisors Cost?

Today, millennials and Gen Z are increasingly interested in investing money for long-term growth. This has led to a rise in financial advisors, with the total number growing about 7% to 8% between 2020 and 2025. Still, many people worry about the cost to see a financial advisor and whether they can be trusted.

Don’t worry — here’s a simple guide to financial advisor fees.

Financial advisors may be fee-only or fee-based. Fee-only advisors earn money exclusively from client fees and don’t get commissions from selling products. Fee-based advisors earn both client fees and commissions, which can create potential conflicts of interest but still follow fiduciary rules.

Most financial advisors use one of four common fee models to charge for their services, and understanding these options can help you choose the right advisor and know what to expect.

Assets Under Management (AUM) Fees

This is the most common fee structure, used by 92% of advisors. Advisors charge a percentage of the assets they manage, typically 0.5% to 1% per year. Graduated schedules apply different rates to asset tiers, for example, 1% for the first $1 million, 0.8% for the next $1.5 million, and so on. Cliff schedules apply a single rate to the entire portfolio based on the highest tier.

Hourly Charges

Some advisors charge only for the time they spend working with you. The median hourly fee is $300, with a typical range of $150–$400 per hour. This model is ideal for one-time consultations or limited planning needs.

Project-Based / Standalone Planning Fees

For a one-time comprehensive financial plan, advisors often charge a flat fee. The median cost in 2024 is $3,000, with simpler plans around $2,750 and more detailed plans $3,500 or more. This model is best for people who want a plan but may not need ongoing management.

Retainer / Subscription Fees

Some advisors offer ongoing access for a fixed yearly fee. The median annual cost is $4,500, up from $3,000 in 2022. This model is often combined with AUM or project-based fees and works well for clients who want continuous guidance.

Commission-Based Fees

Advisors earn a commission when you buy or sell certain products, such as mutual funds or insurance. Commissions usually range from 3% to 6% of the transaction. This model can create conflicts of interest, so it’s important to understand how the advisor earns before signing up.

Financial Advisor Cost Comparison Table

Fee Type |

Typical Cost |

Best For |

|---|---|---|

|

Assets Under Management (AUM) |

0.5% – 1% of portfolio per year (Graduated/Cliff) |

Investors with growing portfolios needing ongoing management |

|

Hourly Rate |

$150 – $400 per hour (Median $300) |

One-time consultations or limited planning |

|

Project-Based / Flat Fee |

$2,750 – $3,500 for standalone plans |

Individuals needing a one-time comprehensive plan |

|

Retainer / Subscription |

Median $4,500 per year |

Ongoing advice and access without AUM-based fees |

|

Commission-Based |

3% – 6% per investment transaction |

Buying specific financial products may include conflicts of interest |

DIY Investing vs. Professional Investment Management

There is a long debate in today’s dynamic market growth about whether people should invest on their own or use professional investment management firms. Both approaches have their advantages and disadvantages, and their value can differ depending on your financial goals and experience. Understanding these differences can help you decide which option is right for you.

DIY investing is popular among younger investors using apps like Robinhood, Vanguard, or Fidelity. It is low-cost and gives you full control over researching and managing your own portfolio. However, it comes with risks like emotional decision-making, poor diversification, and missed tax strategies.

Professional investment management charges fees, which can be flat, hourly, or a percentage of your assets. In return, you get expert guidance, financial planning services, retirement strategies, tax optimization, and disciplined management of investment portfolios during market ups and downs. This approach helps reduce mistakes and supports long-term portfolio growth.

The key takeaway is that DIY saves money upfront but costs time and carries a higher risk. On the other hand, Professional management costs more, but it helps you make better decisions and grow your wealth over the long term.

Difference Between DIY Investing and Professional Investment Management

Aspect |

DIY Investing |

Professional Management |

|---|---|---|

|

Cost |

Very low, often free trades |

Fees: flat, hourly, or % of assets |

|

Control |

Full control over investments |

Advisor makes recommendations, you approve |

|

Expertise |

Relies on your knowledge |

Access to financial planning and market expertise |

|

Time & Effort |

High, you manage research, rebalancing, and taxes |

Low, the advisor handles management and monitoring |

|

Risks |

Emotional investing, poor diversification, and missed tax strategies |

Market risk, but guidance helps reduce errors |

|

Best For |

Small portfolios, hands-on investors |

Long-term investors, retirement planning, and complex financial situations |

Factors To Consider Beyond The Fee Structure for Financial Planning

While cost is an important consideration, choosing the right financial advisor involves much more than comparing fees. The quality of your financial outcomes depends heavily on trust, expertise, and the strength of your working relationship.

Here are the most important factors to evaluate beyond the fee structure:

1. Fiduciary Duty and Ethical Standard

A fiduciary advisor is legally and ethically required to act in your best interest, prioritizing your financial well-being above any personal or firm incentives. This standard helps ensure unbiased advice and transparency.

Advisors who are not fiduciaries follow a lower “suitability standard”, meaning they only need to recommend products that fit your situation but may not be the best or most affordable options.

Actionable Tip: Always ask, “Do you act as a fiduciary at all times?” and get this commitment in writing.

2. Credentials and Professional Experience

An advisor’s qualifications reflect their expertise and commitment to professional standards.

- Certified Financial Planner (CFP®): Comprehensive training in financial planning and ethics.

- Chartered Financial Analyst (CFA): Deep expertise in investment analysis and portfolio management.

- Certified Public Accountant (CPA): Strong background in tax strategy and compliance.

Also look for specialized expertise in areas relevant to you—such as retirement planning, estate planning, small business finances, or tax-efficient investment strategies.

Before hiring, verify their regulatory record for disciplinary actions using trusted sources like the SEC’s Investment Adviser Public Disclosure (IAPD) or FINRA BrokerCheck.

3. Investment Philosophy and Approach

Every advisor has a unique investment philosophy. Make sure their strategy, whether active, passive, or hybrid, matches your risk tolerance, time frame, and financial goals. Ask how they make decisions during volatile markets and how they balance growth with risk management.

4. Communication, Transparency, and Accessibility

Good communication is essential for a successful long-term partnership. Look for an advisor who:

- Explains strategies clearly and avoids unnecessary jargon.

- Is transparent about costs, potential conflicts of interest, and performance reporting.

- Is responsive and available during critical moments, such as market downturns or major life transitions.

You should feel comfortable asking questions and confident that your advisor listens carefully and tailors recommendations to your situation.

5. Services and Value Offered

Understand exactly what services are included in the fee. Some advisors focus only on investment management, while others provide comprehensive planning, which may include:

- Retirement and income planners

- Tax and estate strategies

- Insurance and risk management

- Education or legacy planning

Consider the total value an advisor provides—not just the price tag. A skilled advisor can help improve long-term returns, reduce tax liabilities, and prevent costly mistakes that easily outweigh their fees.

6. Relationship Fit and Trust

Beyond credentials and performance, personal rapport matters. You’ll be sharing deeply personal financial information, so it’s vital to work with someone you trust, respect, and feel comfortable with.

Seek an investment advisor who listens more than they talk, demonstrates genuine care for your goals, and maintains consistent follow-up.

7. References and Due Diligence

Before deciding, meet with at least two or three top financial advisors and investors to compare approaches and personalities. Ask for client references with goals similar to yours and check their track record. Referrals from trusted friends or colleagues can also provide a valuable perspective.

Hidden Costs and Transparent Fees to Watch For

When hiring a financial advisor, hidden costs can quietly erode your returns and create conflicts of interest if the advisor’s incentives are not aligned with yours. By contrast, transparent fee structures ensure accountability and help you clearly understand what you’re paying for — and why.

1. Commissions on Financial Products

Advisors earning commissions may recommend products that generate higher payouts for themselves rather than what’s best for you.

- Examples: Mutual fund sales loads, annuities, insurance policies.

- Risk: You could be steered toward high-commission investments even if lower-cost alternatives better suit your financial goals.

2. Layered Expense Ratios

Investment fees often stack up in multiple layers, increasing costs beyond the advisor’s fee.

- Examples:

- Advisor’s AUM (Assets Under Management) fee — a percentage of your portfolio.

- Underlying fund expense ratios — annual fees charged by mutual funds or ETFs held in your portfolio.

- Risk: These fees compound over time, and higher-cost funds may not outperform low-cost index funds, reducing overall portfolio growth.

3. Excessive Trading and Transaction Fees

Frequent buying and selling can generate additional charges even in commission-free accounts.

- Examples: Redemption fees, brokerage commissions, bid-ask spreads for illiquid assets.

- Risk: Increased transaction costs and taxes can significantly lower net returns.

4. Account and Administrative Fees

Some fees are related to account maintenance rather than investment performance.

- Examples: Inactivity fees, custodial fees, and wire transfer fees.

- Risk: Over time, these charges can quietly erode your wealth.

Transparent Fee Structures to Look For

1. Fee-Only Advisors

“Fee-only” advisors are paid solely by their clients, not through product commissions. This model minimizes conflicts of interest and provides clear cost expectations. Common fee-only models include:

- Assets Under Management (AUM): 0.5%–1.5% annually, often decreasing as assets grow.

- Flat fee: A one-time charge for a specific service, such as a financial plan.

- Hourly rate: Typically average hourly charge for a financial advisor is $150–$400 for advice or consultation.

- Retainer/subscription: A fixed monthly or quarterly fee for ongoing guidance.

2. Fiduciary Standard

A fiduciary advisor is legally bound to act in your best interest. This distinguishes them from non-fiduciary or “suitability standard” advisors, who only need to recommend investments deemed suitable—even if better, lower-cost options exist.

Tip: Confirm in writing that your financial consultant acts as a fiduciary at all times.

When DIY Investing Makes More Sense

DIY investing isn’t about beating the market but reducing costs and behavioral mistakes to capture full market returns. Managing your own portfolio has grown in popularity. A May 2024 Broadridge study found that self-directed assets rose from 14% in 2018 to 23% in 2023. Notably, 45% of Gen Z are already investing, many before age 20.

A quick setup where DIY investing makes more sense than hiring personal financial advisors

-

You want to save on fees

-

You Want Total Control and Customization

-

You Have Simple Goals and Time to Dedicate

-

You Possess Emotional Discipline

-

You enjoy learning about finance

Red Flags When Choosing a Financial Advisor

Financial fraud is a growing concern, as a recent Bankrate survey found that 1 in 3 U.S. adults faced a scam in the past year, with 37% losing money. When choosing a financial advisor, watch for red flags related to their business practices, fees, and trustworthiness. Asking the right questions and checking their background can help you stay safe.

If you want to be in this situation, check out the 10 major red flags to watch out for while hiring a financial advisor for yourself:

-

Promises of guaranteed or unusually high returns – No legitimate advisor can assure profit without risk.

-

Pressure to act quickly – Limited-time offers or urgent pitches are classic manipulation tactics.

-

Vague or hidden fees – Advisors who can’t clearly explain how they’re paid are a big warning sign.

-

Not a fiduciary – If they won’t confirm in writing that they act in your best interest, walk away.

-

Lack of credentials or experience – Verify qualifications like CFP or relevant financial licenses.

-

Unclear investment strategies – A trustworthy personal financial advisor should explain their plan in simple, understandable terms.

-

Poor communication or unresponsiveness – An advisor who avoids updates or ignores your questions isn’t reliable.

-

Excessive trading or risk-taking – Frequent trades or overly aggressive strategies often benefit the advisor, not you.

-

Trouble with regulators or past complaints – Always check their record on FINRA’s BrokerCheck or similar databases.

-

Refusal to provide references or transparency – Honest advisors are open about their clients’ experiences and background.

How to Decide If You Should Hire a Financial Advisor

- Financial Advisor for Personal Finances

Best for individuals who need guidance with budgeting, managing debt, and building emergency savings. These advisors help you establish a solid financial foundation and improve cash flow management. - Financial Planning for Retirement Planning

Ideal for retirees and pre-retirees seeking sustainable income strategies, Social Security optimization, and risk management to ensure long-term financial security. - Financial Advisor for Children’s Future

Advisors can assist in setting up education funds like 529 plans, creating inheritance strategies, and balancing retirement goals while securing your children’s financial future. - Investment Advisor for Long-Term Income

Best suited for high-net-worth individuals or anyone seeking consistent, long-term portfolio growth. These advisors specialize in wealth preservation, dividend income, and tax-efficient investment strategies.

List of Top 10 Investment Management Companies.

These top investment management firms are industry leaders known for their expertise in financial planning, wealth management, and long-term investment strategies. They help individuals and institutions grow and protect their assets through professional guidance from the best financial advisors, diversified portfolios, and personalized financial solutions.

1. BlackRock

One of the great financial advisors globally, BlackRock is the world’s largest asset manager, renowned for its iShares ETFs and data-driven investment solutions.

Pioneer of low-cost index funds and ETFs, popular among long-term, cost-conscious investors.

3. Fidelity Investments

Offers a broad range of mutual funds, brokerage services, and retirement solutions with strong research capabilities.

4. State Street Global Advisors

Known for managing institutional portfolios and the SPDR ETF series, including the S&P 500 ETF (SPY).

5. J.P. Morgan Asset Management

Provides active management strategies backed by deep research and global market expertise.

6. Capital Group

Creator of the American Funds family, emphasizing active management and long-term performance.

7. Goldman Sachs Asset Management

Offers sophisticated investment solutions and alternative strategies for institutional and high-net-worth clients.

8. Morgan Stanley Investment Management

Focuses on active management and sustainable investing across global asset classes.

9. T. Rowe Price

Renowned for its disciplined active management approach and strong track record in mutual funds.

10. Invesco Ltd.

A global investment firm offering a diverse range of ETFs, mutual funds, and custom portfolio solutions.

Conclusion

Coming from a family where investing was never tried feels intimidating. Gen Z is embracing stocks and ETFs early. A beginner-friendly financial advisor can guide you safely.

At the end of the day, choosing DIY or an advisor depends on your knowledge and time. Confidence and commitment determine which approach works best. The right guidance makes investing less risky and more rewarding.

Sound financial planning builds wealth and prevents costly mistakes. Professional advice from investment management firms helps set realistic long-term goals. Start smart to secure financial security and growth.

FAQs

Financial advisors help individuals manage money and reach financial goals through personalized plans. They offer guidance on investments, taxes, insurance, debt, and estate planning while managing risk. Advisors monitor progress, adjust strategies, and simplify complex financial decisions for long-term stability.

A fiduciary financial advisor acts in the client’s best financial interest, offering transparent, unbiased advice. They must disclose conflicts of interest and avoid self-serving recommendations. Fiduciary advisors prioritize loyalty, care, and transparency to ensure clients’ goals and financial well-being come first.

Cost of a financial advisor varies by service type and fee structure. Most charge around 1% of assets under management annually, while flat fees range from $1,000 to $7,500. The Hourly financial advisor rates likely are between $150–$400, and commission-based fees range from 3%–6%.

Most financial advisors typically follow an Assets Under Management (AUM) fee model. They charge a yearly percentage of the client’s portfolio, usually between 0.5% and 1.75%. Some also offer flat, hourly, or commission-based options for flexibility.

Hiring a financial advisor provides expert guidance, personalized planning, and emotional confidence. They help manage investments, optimize taxes, and create holistic financial strategies tailored to your goals. With their knowledge and objectivity, advisors improve decision-making and long-term financial security.

To choose a financial advisor, start by identifying your financial goals and the type of help you need. Research potential advisors carefully by checking their credentials, fiduciary status, and experience. Interview top candidates, compare their fees, communication style, and transparency, then choose the one you trust to guide your long-term financial journey.

When choosing a financial advisor, ask about their fees, experience, and fiduciary status. Learn how they invest, communicate, and manage taxes or retirement planner. These questions ensure their approach aligns with your financial goals.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

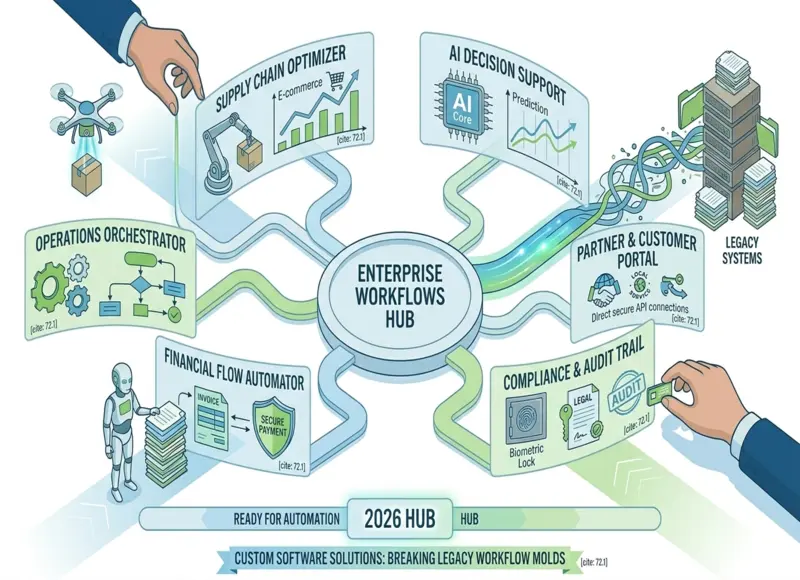

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127