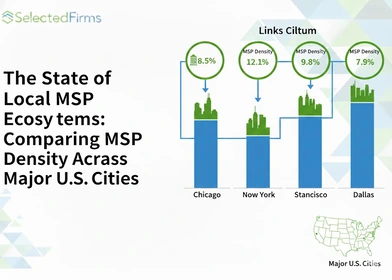

The State of Local MSP Ecosystems: Comparing MSP Density Across Major U.S. Cities

-

Last Updated:

06 Feb 2026

-

Read Time:

7 Min Read

-

Written By:

Elia Martell

Elia Martell

-

388

Table of Contents

A data-informed look at how Managed Service Provider (MSP) presence differs across U.S. metro areas, and how population, economy, and infrastructure shape local IT service ecosystems.

When you are searching for the right Managed Service Provider in any US city, it can get difficult. Businesses have to struggle with coming across reliable IT support with so many available options. Moreover, some metro areas do not have ample MSPs to meet their demand.

Did you know that there are a lot more MSPs in big cities like New York and Los Angeles than in smaller markets in the middle of the country? The number of people who live there isn't the only thing that makes these places different; the economy and local laws have a lot to do with it too. Businesses will be able to make better decisions when they understand the trends.

Methods of Comparison

Analysts collected data from city-level population statistics and business registry databases. The data helped with important details on the MSPs that were active in different areas.

The team also looked into the directories and local networks of IT services. This helped them make a comparison between cities with different levels of urban development.

Industry surveys helped clarify how MSPs are distributed across regional hubs compared to smaller metro areas.

To find the MSP density, divide the number of providers by the number of people. This calculation shows how many services are available based on the size of the community.

Another factor is the number of businesses served per MSP. A higher ratio suggests demand outweighs supply, while a lower ratio signals possible saturation. Local economic activity also plays a role; dense business hubs often encourage more competition and growth for IT services.

Important Trends

Growth

San Francisco and Austin are two cities with a lot of technology that are great for MSP growth. Businesses that need managed IT services are drawn to them because they have a lot of people and a lot of economic activity. The infrastructure needs of businesses, startups, and people who work from home grow as they do. One expert in the field said, "Growing populations make the need for reliable tech support even greater." Tech hubs are also better off when they are near centres of innovation. Even secondary markets are catching up by focusing on certain industries or niche solutions that are made to meet the needs of the area.

Differences between regions

There are a lot of Managed Service Providers in some parts of the U.S. Coastal areas have extensive MSP networks. This is because they have a high demand for IT services.

Highest MSP Cities

New York City

The city has a highly dense MSP market in the entire country. There are more than 8 million residents and multiple businesses. Therefore, there is a great demand for managed IT services.

The competitive nature of its economy forces local MSPs to focus on specialized areas like cybersecurity or cloud management.

Economic hubs such as Manhattan and Brooklyn fuel most of this growth. Financial firms, tech companies, and healthcare providers depend significantly on outsourced IT solutions to manage their infrastructures.

Intense competition drives quality service. However, it also creates pricing challenges for smaller providers that want to expand operations. In highly competitive markets, credibility and visibility play an outsized role in winning deals. This has been revealed by Jumpfactor in its overview of New York managed IT providers.

Los Angeles

It has one of the highest MSP concentrations in the U.S. The city is known for its growing economy. This increases demand for managed IT services. There are over 10 million residents in Los Angeles County alone. Therefore, bbusinesses require flexible IT solutions to manage growing digital needs.

The region's diverse business environment attracts a combination of local MSPs and national providers eager to compete.

Chicago

The city boasts a growing MSP market. With over 2.7 million residents within city limits, businesses depend greatly on managed IT services to remain competitive.

Entrepreneurs who need infrastructure support are interested in the city's role as an economic hub.

The local government helps businesses grow by giving small businesses tax breaks and making the area more welcoming for MSPs. Its city planning makes it easy to get to clients and resources. This gives the city chances that other cities have trouble copying.

Cities with the Lowest MSP Density

These areas often show urban centers on a smaller and less dense scale. For instance, while Chicago grows as a business center, nearby rural regions like Rockford provide smaller-scale versions of similar offerings. These regions may have fewer Managed Service Providers. Still, they support local businesses efficiently.

Population density significantly affects MSP availability. Cities like New York experience high client demand due to densely populated urban areas. Areas that are similar to this city depend on a community system.

Businesses there might depend on one or two dependable providers. The presence of limited economic hubs can decrease the overall excitement for these services, especially when you perform a regional comparison of IT service providers.

Cities without active industries or varied business networks often face challenges in attracting these services. A sparse population also reduces client opportunities. This makes it harder for MSPs to expand or maintain operations.

Low density is also caused by infrastructure gaps. MSPs can face troubles executing their jobs due to improper city planning. When service providers are not able to connect to the internet properly, it becomes difficult for them to offer proper services.

There are multiple MSPs in the East Coast cities. You will also come across them in the middle of the country. These are better places because they have a high population. MSPs help many businesses in these areas to run more smoothly.

Cities like Philadelphia are also growing because they are near the healthcare and financial sectors. A comparison of IT service providers in a certain area can help businesses find trustworthy partners in crowded markets by showing them how well their services fit and what they focus on. Their infrastructure makes it easy for service providers to grow quickly and enter new markets. MSPs offer specialised solutions tailored to local businesses because there is a lot of competition in cities.

West Coast cities

West Coast cities, like Los Angeles and San Francisco, are home to some of the busiest MSP markets in the U.S. High population and the presence of multiple tech industries are responsible for this expansion.

Los Angeles is also known for its overall size and economic strength. Here, the entertainment industry creates a proper need for specialised MSPs.

With so many small to mid-sized companies establishing operations on the West Coast, competition among providers remains intense.

Midwest and Southern cities

Midwest cities like Chicago and Minneapolis are showing steady growth in managed service providers. These areas feature affordable living costs and increasing tech sectors.

Businesses in these areas use managed services to reduce expenses and simplify operations. As there are multiple small & mid-sized companies in these regions, the demand is rising continuously.

Atlanta and Nashville are also experiencing progress in this market. Rapid population increases fuel this trend as businesses work to support their growing customer bases. Many firms rely on Managed Service Providers for flexible IT solutions, especially where infrastructure is catching up with urban development spikes.

MSP density is directly proportional to the growth of economic hubs. Megacities have growing businesses that are highly dependent on IT infrastructure. These areas always look out for tech support to maintain operations.

Higher population density in these hubs also supports MSP growth. With more people, you can expect more businesses available for customers. Large populations in metro areas will lead to high MSP density. Mega cities have major population clusters. Therefore, these areas experience more demand for managed IT service.

High-density living fosters concentrated economic hubs. Here, businesses look for dependable IT infrastructure to stay competitive.

Sprawling rural areas face challenges that limit MSP growth. Here, smaller populations are spread over wide regions. Therefore, the demand is also distributed among different providers. The low number of residents & businesses can reduce opportunities.

City regulations also determine MSP growth. The presence of simply permitting processes and tax incentives offers access to more IT services.

Cities like Austin have benefited from policies that encourage tech investment, creating favorable conditions for managed service providers.

The laws across different zones and infrastructure funding also affect MSPs. If there are economic regions that support technology growth, it will make it easier for providers to meet the overall demand.

Urban planning directly affects MSP growth in metropolitan areas. Well-organized public transportation systems make it more convenient for businesses to access IT services. Reliable infrastructure, like high-speed internet and dependable utility networks, supports the operations of managed service providers.

Poorly planned urban environments can restrict expansion. Areas with aging grids or insufficient transit options reduce new investments from IT firms. Designed business districts, in contrast, often draw more MSP activity due to accessible workspace and enhanced resources for companies.

Case Studies

Minneapolis-St. Paul

The area is known for its rising local economies and strong emphasis on technology. The area’s large corporate presence includes Fortune 500 companies like Target and 3M. This creates great demand for managed IT services.

Investments in urban development and dependable infrastructure further attract IT service providers to establish operations here.

San Francisco Bay Area

The overall economic growth and high population density in the region create a strong need for MSPs. Companies here depend on these services to manage IT solutions.

Rising operational costs remain a struggle for smaller providers. High rent prices and salaries squeeze profit margins. This makes it tough to compete with larger firms. Despite these challenges, the area remains one of the most competitive hubs for IT service networks in the United States.

Austin

Austin stands out as a rapidly expanding center for managed service providers. With its growing population and growing tech industry, the city has experienced a major increase in MSP presence over recent years.

Companies are relocating to Austin. They are attracted to its strong economy and highly capable workforce. The city also benefits from a combination of startups and established corporations, driving consistent demand for IT services.

Local government policies further support MSP growth through tax incentives and business-friendly regulations. Urban development projects align with the city's rapid expansion, addressing infrastructure needs for growing businesses. These factors make Austin an appealing choice for MSPs and clients looking for dependable IT solutions in one of the country’s most energetic metropolitan areas.

Challenges

In cities like New York, Los Angeles, and Chicago, the sheer number of providers creates an ongoing battle for clients. Smaller MSPs often struggle to compete with larger companies offering more services at lower prices. Even mid-sized businesses face pressure to set themselves apart through superior customer service.

Market saturation also limits growth opportunities. With most industries already serviced by multiple providers, finding untapped segments becomes harder. Some MSPs resort to aggressive pricing strategies. This can lead to slimmer profit margins. Others focus on emerging technology trends like AI or cloud services to carve out specialized roles in highly competitive regions.

Economic growth in certain cities increases demand for managed IT services, while population changes influence where MSPs succeed. For example, New York City and Los Angeles gain advantages from being economic centers with dense populations. High business activity results in a consistent need for IT infrastructure support.

Smaller metro areas with slower growth often present fewer opportunities for service providers. Businesses moving to growing regions like Austin increase competition there. However, it creates voids in areas experiencing stagnation. This change affects the market size and how MSPs organize their operations.

Opportunities for Growth

Local economies in smaller metro areas are providing greater opportunities for managed service providers. Cities like Boise, Idaho, and Greenville, South Carolina, are experiencing steady population growth in addition to business expansions. More businesses in these regions now require dependable IT services to support operations.

Many of these markets lack the intense competition present in larger metropolitan areas. This creates opportunities for service providers to establish meaningful relationships with growing companies early on. Affordable real estate and a lower cost of living also make setting up operations simpler compared to major cities.

Smaller markets are expanding. Also, technology keeps making MSP services better. Cloud computing and AI-powered tools are now essential for businesses to run their daily operations. These changes make it even more important to have skilled Managed Service Providers who can handle complex systems well.

Cybersecurity threats also make people want more. Businesses depend on MSPs to keep sensitive data safe and follow the rules because attacks are getting more sophisticated. As technology evolves quickly, companies count on providers who remain competitive in the market.

Conclusion

MSP density reveals much about a city's growth and technology requirements. Some cities flourish as centers, while others encounter challenges in creating strong networks. By examining these trends, businesses can discover newer markets and fresh opportunities. The future of MSPs will depend on balancing competition with progress across various regions. Every city holds its own potential for IT success if approached thoughtfully.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

88

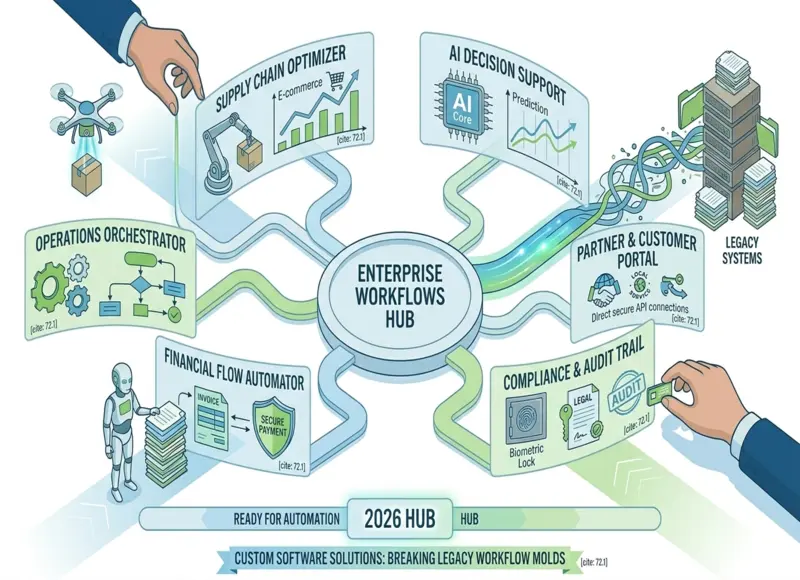

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

96