Table of Contents

Explore the impact of top tech companies on online trading. Learn about innovative IT solutions that are shaping the future of the trading industry.

Online trading has forever changed how financial markets operate. Computers and smartphones have become powerful enough for brokers to introduce more advanced platforms. This phenomenon has allowed retail financial traders and investors unprecedented access to financial markets.

The backbone of this revolution, together with technology, is the swift development of advanced IT solutions. These firms have adapted their platforms to financial trader needs and have created user-friendly software beloved by millions of traders worldwide. Let’s explore some of the best tech companies responsible for driving innovation with these platforms in online financial trading.

The Role Of Technology In Online Trading

Technology is the sole reason behind the rising popularity of online trading in general despite the field. Financial trading has improved with new technology, making it possible to build advanced trading platforms. These platforms let traders access financial markets and trade various financial instruments.

The top trading platforms include cTrader, MetaTrader 4, MetaTrader 5, and TradingView. cTrader lets traders access financial markets, use custom indicators, and run automated trading robots. Like other platforms, it provides traders with complex charting and technical tools to aid market analysis and improved decision-making. With technology and these platforms, connecting with exchangers and trading is possible, as traders used phones to trade on trading floors before.

Beyond powerful platforms and AI-driven tools, traders need a regulated Online trading broker to connect strategies to live markets. The right broker delivers reliable execution, competitive pricing on forex and CFD instruments, and institutional-grade infrastructure—MT4/MT5 support, APIs for automation, VPS hosting, and secure mobile access. Combining these services with advanced charting and backtesting helps retail and professional traders deploy and monitor algorithms effectively while managing risk with features like negative balance protection and configurable stop orders.

Let’s consider different innovative technologies that start to revolutionise trading again.

Artificial Intelligence And Machine Learning

AI and ML have become popular lately due to their unique ability to complete tasks without ambiguous programming. These smart algorithms learn small datasets to achieve specific goals, and many corporations, including hedge funds, have started investing in these technologies.

Advanced trading platforms also started support for AI and machine learning in their programming environments, allowing developers to deploy AI-powered trading bots and enhance accuracy.

API And Data Analysis

Application Programming Interfaces (APIs) allow trading robots on 3rd party platforms to connect with brokers and trade on financial exchanges. APIs allow traders to automate their strategies, connect external platforms, and integrate tools that would be impossible otherwise. API and other programming-related trading needs caused many developers to develop advanced trading robots for traders.

Blockchain Technology At The Forefront Of Transparency

Blockchain technology puts transparency, security, and trust in online trading platforms to the table. It has not yet been widely adopted, but decentralised platforms offer all of these features, which traders can use to search for trading opportunities. Also, all platforms offer cryptos for trading these assets, often CFDs or Contracts for Differences. CFDs allow traders to speculate on cryptos without owning the underlying crypto. This makes CFDs both very versatile and risky at the same time.

For example, MetaTrader 5 (MT5) has integrated cloud computing to provide enhanced backtesting and trading simulation features. MT5 cloud features allow traders to run complex trading algorithms (Expert Advisors) and analyse historical data without expensive local hardware.

Cloud Computing For Superior Accessibility

Cloud computing has become very popular with the introduction of VPS services and scalability.

Traders can use cloud computing services to access trading platforms from anywhere in the world at any time, providing a seamless trading experience.

Virtual private servers let traders run their robots in the cloud, giving them 24/7 access without worrying about hardware issues or losing connection. Even if the local computer or device fails, VPS will continue to work securely, ensuring expert advisors work seamlessly.

Mobile Trading Platform Apps: Trading On The Go

With fast-advancing mobile technologies and modern budget smartphones, traders can now possess enormous computing power in their pockets. Mobile trading apps got upgrades, including the new MT5 app, which offers advanced features and numerous built-in indicators.

Mobile platforms have also become crucial for institutional traders. Traders with mobile phones as their daily drives can now download mobile trading apps and start trading without needing desktop computers or laptops. Surely, having a giant screen and properly analysing markets is always much better, but having your platform anywhere you go is very flexible.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

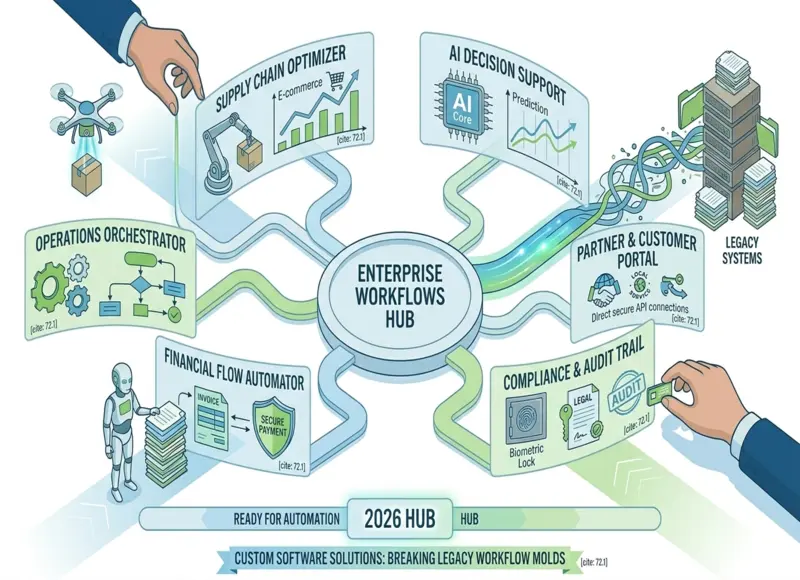

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127