Table of Contents

Onboarding makes or breaks user experience. Whether it's a fintech app, crypto platform, or marketplace, secure and smooth onboarding is key, and KYC plays a central role in balancing compliance and convenience.

KYC, or Know Your Customer, isn’t just about following rules anymore. It’s now a key part of the user experience. For businesses that need to confirm who their users are, stop fraud, and follow local laws, KYC is essential. When done right, it makes onboarding faster and helps more users complete the signup process. Executed poorly, it can anger users and lead to high churn.

Let's look at why KYC is evolving and why more businesses are integrating it as an effortless part of onboarding.

Why Frictionless Onboarding Matters

Customers nowadays expect a lot. They expect immediate access to products and services, and they're not going to jump through hoops to get it. If your sign-up process is clunky or confusing, Many will opt out and use a competitor that offers a simpler experience.

That's why onboarding is not just a UX design issue. It's a business risk. If companies are unable to create a quick, secure, and seamless onboarding experience, they risk losing users who are worth their while before they've even begun.

Think about how much effort and time it costs to get each new user. Content, outreach and referral programs, and advertising are all on the front lines of getting someone onto your platform. But then, if they make it to your signup page and there's slowness, errors, or friction, all that work could be wasted. Frictionless onboarding isn't only conversion-friendly. It builds trust from the very beginning.

Of course, you can't leave the gates wide open for everyone. Identity theft, underage access and financial crime are significant concerns to most industries. That's where KYC enters the scene.

What is KYC and Why Is It Important?

KYC is a process businesses use to verify the identity of users before access to certain services. It's a regulatory obligation in the finance, crypto, gambling, and payments industries, but more and more other businesses outside those areas are implementing it as well, especially those that handle sensitive data or money flows.

The core processes of KYC tend to be:

- Collecting and confirming ID documents

- Verifying address and date of birth

- Checking for red flags like fake or expired documents

- In some cases, performing biometric checks like face recognition or liveness detection

These help companies confirm with whom they're dealing, comply with the law, and prevent fraud. For customers, a seamless KYC process can make them feel secure. It tells them that the company is concerned with privacy and security.

And beyond regulation compliance, there is a clear commercial benefit. Platforms that perform verification effectively enjoy higher conversion, fewer manual checks, and better long-term customer satisfaction.

Where Most Businesses Struggle with KYC

Businesses today can no longer afford a one-size-fits-all method of verification. Each customer journey is individual, and the expectations for speed as well as convenience have never been higher, so flexibility is essential. A robust KYC system should be adaptable to different user profiles, geographies, and risk levels without being the chokepoint. Whether it is onboarding a teenager buying their first crypto token or a retiree creating a virtual bank account, the system needs to deliver the right level of verification at the right time. Context-aware, adaptive workflows are the signature of modern platforms over old-school KYC practices.

While mandatory, KYC is oftentimes seen as a hurdle. Manual checks, outdated systems and unclear guidelines can all result in delay and friction. Some of the most frequent problems companies face are the following:

- Delays in processing

Manual checking of documents and photos can take days or hours, especially when volumes peak.

- Drop-offs upon sign-up

If the KYC experience seems too onerous or complex, users will abandon the process.

- Global compliance challenges

Not all regions are equal. Compliance is difficult without the right tools.

- Identity theft and fraud

Minimum KYC checks cannot possibly identify sophisticated fakes or fake identities.

Another often underleveraged test is to verify a user's home address. In the majority of industries, address validation is as important as ID verification. But manually validating utility bills, bank statements, or government letters is time-consuming, inconsistent, and hard to scale.

That’s why more and more companies are embracing automated proof of address verification. These systems extract and verify address data straight from documents, which hastens the process and makes it more accurate. For business, it saves time and ensures compliance. For customers, it offers a less cumbersome onboarding with fewer back-and-forths.

How Automation Improves the KYC Experience

New KYC systems are designed to reduce friction without sacrificing high security levels. They utilize the application of machine learning, OCR (Optical Character Recognition), biometric authentication, and database checking to automate what was once a time-consuming manual procedure.

Here's why:

- Instant document verification

IDs, passports, and driving licenses can be scanned and verified in seconds.

- Facial matching and liveness detection

Avoid identity fraud by checking that the person presenting the ID is present and matches the photo.

- Automated data capture

Reduce human error by automatically capturing name, date of birth and address data from documents.

- Localized compliance

Adjust workflows based on the location of the user to meet local requirements.

- Scalable infrastructure

Handle large numbers of signups without bottlenecks or staffing issues.

By integrating these tools into their onboarding process, companies can enjoy high security and compliance levels without compromising speed or customer satisfaction.

Use Cases Across Industries

KYC has become a necessity in more industries than ever. Some of the areas where it has a direct influence on customer experience and business success are as follows:

Fintech and Digital Banking

Account opening, borrowing, and wallet services all rely upon fast but secure onboarding. Automated KYC verifies users are real and reduces compliance risk.

Cryptocurrency Exchanges

KYC is required in a highly regulated, high-risk environment to prevent fraud and money laundering. Real-time verification also helps exchanges establish credibility and trust with users.

iGaming and Gambling

Age verification is critical in this case. KYC keeps minors off the platform and allows compliance with local gaming regulations.

Online Marketplaces

Both buyer and seller authentication create trust. This is especially true where platforms are user-to-user and reputation-based.

E-commerce and High Value Retail

For businesses selling high-value or controlled items, verifying a buyer's identity and address reduces fraud and chargebacks.

Why KYC Should Be a Built-In Advantage

Too often, businesses treat KYC as an afterthought, something to be plugged in once traction starts or when regulators start asking questions. But KYC is more than a box to check. It’s an opportunity to create a great first impression, protect your users, and operate with confidence.

When onboarding is easy and secure, customers will more likely sign up, engage with your product, and stay. Smooth KYC can directly influence revenue, retention, and reputation.

And the beauty of it is that new KYC solutions require zero months of development or huge internal teams. APIs and pre-built integrations allow lots of tools to get up and running in weeks or days, not months.

Final Thoughts

KYC doesn't have to hinder progress. It can become a seamless and even beneficial aspect of your onboarding process if you have the appropriate resources and methodology. Businesses can now verify users and maintain compliance more easily thanks to automation, biometrics, and intelligent workflows.

If your current process feels slow, confusing, or too manual, it’s a good idea to review it. Even small changes to KYC can make a big difference in how easily users get started with your product.

Ultimately, users want security, but they require simplicity as well. The most effective onboarding flows deliver both, and that starts with best-in-class KYC done right.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

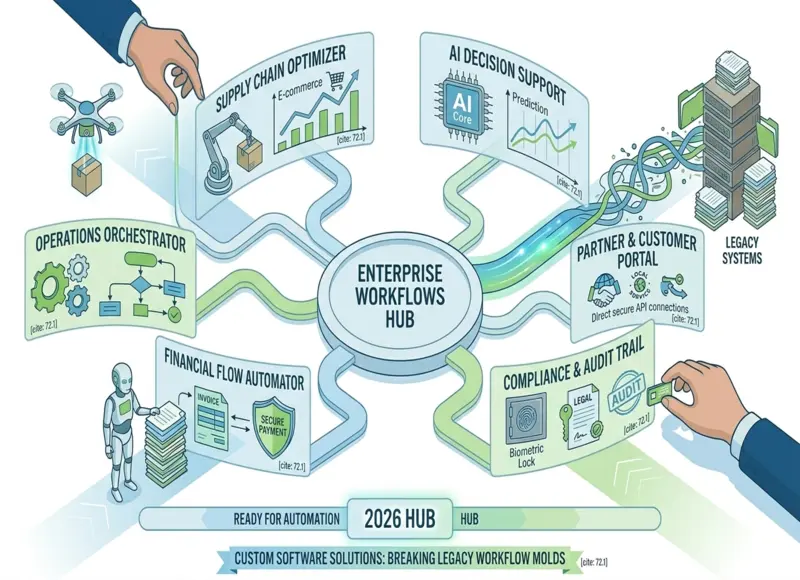

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127