Table of Contents

As rental portfolios grow, spreadsheets quickly become inefficient and error-prone. This guide explains when and why landlords should switch to property management software, how to calculate the ROI, and what features matter most when choosing the right p

When you manage 3–5 units, you can hold most of the details in your head. But scaling to 15–50 units is a different reality. Suddenly, you’re juggling overlapping lease expirations, simultaneous move-ins and move-outs, multiple maintenance issues, and a flood of tenant messages. Complexity doesn’t grow linearly - it multiplies.

Each new unit adds touchpoints:

- Inspections to schedule and document

- Invoices from vendors and contractors

- Renewals to negotiate and execute

- Rent increases to calculate and communicate

- Compliance tasks for local councils and Companies House filings

Spreadsheets struggle when more people get involved. If you hire a virtual assistant or bring on a maintenance coordinator, you now have multiple people editing the same file. Concurrent access leads to file locks, version confusion, and overwritten data. Someone saves a local copy, makes changes, and emails it back - now you’re reconciling two divergent versions.

Cloud systems handle scaling differently:

- Role-based permissions. Your accountant sees financial data. Your maintenance staff sees work orders. Your partner sees portfolio-wide dashboards. Nobody has access beyond what they need.

- Standardized workflows. Templates for notices, leases, and inspection forms ensure consistency whether you manage 10 or 100 units.

- Centralized history. Every change is logged. If your VA updated a tenant’s contact info, you can see when and by whom.

The real benefit? Scaling with software lets you grow without linearly adding staff or hours. A small team can manage 100+ units with the right platform - something that would be impossible, or at least miserable, with spreadsheets.

Imagine acquiring a new 20-unit building in 2026. With spreadsheets, you’d spend weeks setting up new tabs, importing tenant data, and training everyone on your custom system. With cloud software, you import the property, assign user roles, and you’re operational in days.

?

?

Calculating the ROI: When Is It Time to Go Digital?

Many landlords hesitate over subscription costs but underestimate the hidden expenses of spreadsheets: time lost, errors made, and revenue missed.

Let’s do a simple back-of-the-envelope calculation. Suppose you manage 15 units and spend 10 hours per month on manual tracking - chasing rent payments, updating spreadsheets, reconciling bank accounts, and coordinating maintenance via text and phone calls.

|

Factor |

Spreadsheet Approach |

Software Approach |

|---|---|---|

|

Monthly time spent |

10 hours |

3–4 hours |

|

Opportunity cost ($50/hr) |

$500 |

$150–200 |

|

Software subscription |

$0 |

$50–$150/month |

|

Missed late fees (estimated) |

$50–100/month |

$0–20/month |

|

Errors and correction time |

2–3 hours/month |

Minimal |

Even at a modest $50/hour opportunity cost, the spreadsheet approach is more expensive than software - and that’s before counting the stress, missed renewals, and tenant frustration.

Tangible gains from going digital include:

- Faster rent collection. Online payments clear in 2–3 days. Checks can take weeks to mail, deposit, and clear.

- Automatic late fees. No more awkward conversations or forgotten charges. The system handles it.

- Fewer missed renewals. Automated reminders ensure lease renewals don’t slip through the cracks.

- Better tax preparation. Clean, categorized financial data makes 2024–2025 filings faster and cheaper.

A reasonable threshold: once you manage 5–10 units, or spend more than a few hours per week in Excel, the software typically pays for itself. And don’t overlook the soft benefits - reduced stress, better tenant experience, and a professional image that can justify modest rent premiums in a competitive rental market.

Choosing the Right Landlord Software for Your Portfolio

There’s no single “best” tool. The right choice depends on your portfolio size, property type (single-family vs. multifamily), budget, and tech comfort.

Here’s how to approach the decision:

- For 1–20 units, consider affordable, landlord-focused tools. Platforms like RentRedi, TenantCloud, and TurboTenant are designed for small portfolios with user-friendly interfaces and lower monthly costs.

- For 50+ units, look at more advanced suites. Buildium, AppFolio, and DoorLoop offer deeper features, integrations, and automation features suitable for growing property management companies.

Key features to evaluate:

|

Feature |

Why It Matters |

|---|---|

|

Online rent collection |

Core function—look for ACH and card options |

|

Maintenance requests |

Tenant portal with photo uploads and tracking |

|

Document storage |

Digital leases, inspection reports, and important documents |

|

Accounting and reporting |

Built-in ledger, cash flow reports, tax-ready exports |

|

Mobile app quality |

Manage on the go without a laptop |

|

Bank and accounting integrations |

Reduce double entry and manual calculations |

Use free trials or demos. Input a real tenant, log a real maintenance issue, run a sample report. See how the daily workflow feels.

Read recent (2024–2025) user reviews. Focus on portfolios similar to your own. Pay attention to comments about support quality, product stability, and the learning curve.

Watch for hidden costs:

- Per-unit fees that spike as you grow

- Payment processing charges for card transactions

- Onboarding or training fees

- Add-on modules for advanced features

Software selection requires careful consideration because it represents an important choice that companies cannot reverse. Most platforms allow data exports, so you’re not locked in forever. The key is to pick something that fits your current needs and can grow with you.

FAQs

The tipping point is typically somewhere before 5–10 units, but the real trigger is your workload. Are you spending more than a few hours per week manually tracking, making tons of errors in the process, or forgetting lease renewals or rent reminders? Then it's time to consider some sort of software. A lot of landlords also throw in the towel when they hire any sort of help, like a VA or a bookkeeper, because spreadsheets are not great at facilitating cooperation. Sooner or later, you must take the step; clarify how the data should migrate to the new system, and the sooner you make a return on the savings.

Most modern software platforms are designed with landlords who are not tech-savvy in mind. Companies like TenantCloud provide user-friendly platforms, mobile apps, and guided onboarding. There are video tutorials, a help centre, and responsive support teams there to help. The software usually takes a bit of a learning curve, but generally, it takes only a few days or a week to get up and running. If you carry out online banking or file your taxes digitally, you will be able to use a property management package.

Most platforms allow importing historical data through CSV file import. Before migrating, clean up your spreadsheet for 2022-2024: standardise naming, clean off blatant errors, and remove duplicates. The importer is mapping your columns to software fields, listing tenants, properties, payments, and expenses, or what is perceivable. Some vendors, indeed, even have a white-glove onboarder to help with larger datasets. Keep your old spreadsheets archived; you may need them to check numbers or answer some questions during the transition.

Web-based services are typically more secure than locally stored data. Properly secure platforms use encryption in transit and at rest, along with automatic nightly backups and role-based access controls with activity logs. Your laptop, by contrast, can be stolen or damaged, and if you email an unencrypted Excel file to an accountant, the data is at risk every time. Your calf will hardly keep its independence. Still, such cloud systems are rarely breached in the way common among private landlords who use spreadsheets and email.

Yes, the majority of property management software platforms offer data export options that include CSV files for tenant and property records, PDF reports, and downloadable leases and documents. Confirm the export file types available before making a commitment to a particular platform, and verify the process for extracting data. This allows you to free yourself up in case the need arises, enabling you to export your data and easily set up your data in another system. You are already free to ask this question during your trial or demo.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

88

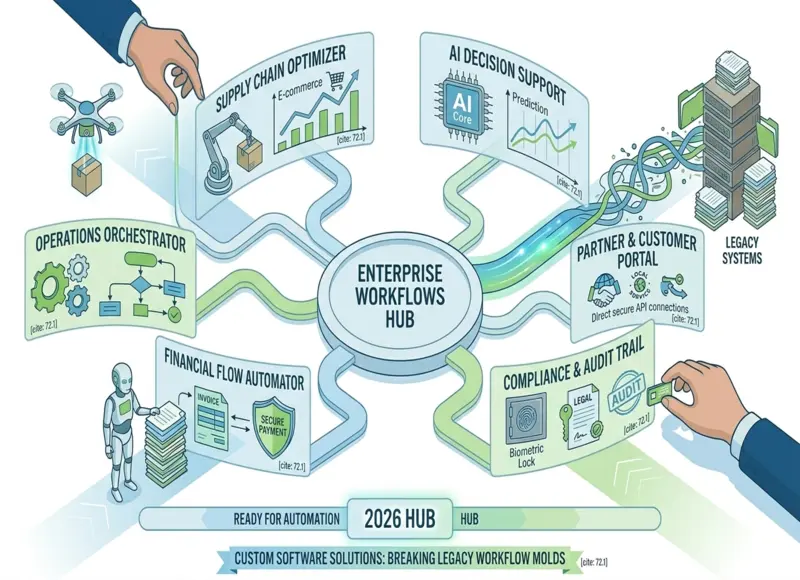

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

96