Table of Contents

Poland stands out in Europe for hiring software developers thanks to its deep talent pool, mature delivery ecosystem, and predictable operating environment.

When companies hire software developers in Europe, the smartest decisions rarely start with a country shortlist. They start with a delivery question: which market can reliably supply the right skills, at the right scale, under predictable legal and operational conditions. In 2026, Poland continues to stand out because the ecosystem supports both outcomes that buyers care about most: consistent talent access and mature vendor delivery.

One signal of long-term capacity is market trajectory. The ICT market in Poland is projected to reach USD 51.23 billion by 2030, which points to sustained investment and a stable demand base for digital services. Another directional marker often mentioned in a business context is Poland’s 40th place in the Ease of Doing Business Ranking, which some teams still use as a historical reference point when discussing operating conditions and market maturity.

What companies should evaluate before choosing a partner in Poland?

A country can be attractive on paper and still deliver mixed results if partner selection is based on branding instead of execution. A better approach is to assess vendors through criteria that map to delivery risk and stakeholder expectations.

A practical checklist for choosing a nearshore partner or building a dedicated development team in Poland includes:

- Governance and delivery cadence (how planning, releases, QA, and change control are run).

- Security posture (access management, secure SDLC habits, and audit readiness).

- Engineering depth (seniority mix, architects, DevOps, and QA maturity).

- Transparency (how progress, blockers, and budget burn are reported).

- Talent continuity (attrition management, backup coverage, and onboarding speed).

- Commercial clarity (IP ownership, exit terms, and what happens when scope changes).

This framing keeps the conversation vendor-focused and solution-focused, rather than country-marketing-focused.

Poland’s 2026 market signals that matter to buyers

Poland has been on the outsourcing map for a long time, yet it stays on shortlists because the ecosystem is large and deeply connected to international clients. It is often labeled the world’s second-largest outsourcing center, which matters less as a bragging point and more as a signal that the market has dealt with real-world delivery expectations at scale.

Recent investment headlines add context for buyers who care about long-term capacity. Google’s announcement of a €590 million investment tied to Warsaw expansion plans suggests continued pressure on talent and stronger incentives for vendors to mature their cloud and security practices. Export figures support the same “global demand” narrative. Poland’s ICT exports reached $16.85 billion in 2023, indicating sustained cross-border consumption of Polish tech work.

There are also policy and operating-environment signals that sourcing teams sometimes track alongside delivery capability. Poland’s move to the 31st position in the International Tax Competitiveness Index is often referenced when discussing predictability for international business structures and longer-term vendor relationships.

Talent supply, skill focus, and working norms

Hiring gets easier when a market has enough “bench depth” to absorb change. Poland is often described as adding about 15,000 IT engineers each year, which helps keep the talent pipeline moving even when companies scale fast or teams need replacements. For buyers, that usually means fewer stalled sprints caused by one missing role and a better chance of finding reasonable coverage for common stacks.

Delivery is also shaped by how people prefer to work, not just where they live. In Poland, remote work is frequently noted as the preference for 53% of job seekers. That number is a reminder to evaluate partners on distributed execution: written documentation, clean handoffs, predictable ceremonies, and onboarding that doesn’t depend on sitting in the same room.

The safest way to source talent is to anchor decisions in what the market is actively staffing, not in generic “full-stack” claims. The most in-demand technologies are often listed as SQL, Python, AI/ML, data science, Java, JavaScript, TypeScript, and PHP. Using that mix as a starting point makes planning more predictable. It clarifies which specialists are typically easy to source, where recruiting may take longer, and how to assemble a well-rounded team so releases and cloud work don’t get stuck because one missing skill keeps blocking progress.

Why Poland keeps winning competitive comparisons in practice

Poland’s reputation is strongly tied to execution capability. The market is frequently described as having high technical proficiency, supported by strong academic foundations and broad commercial experience across domains such as custom software development, cybersecurity, e-commerce, and fintech.

The vendor landscape is also deep enough to support different engagement models. Poland is cited as having a large number of software development companies and specialists, and partner directories reinforce that breadth. For example, marketplace data is often lists many Polish providers across specialties and company sizes. While directories should not replace due diligence, they are useful for building an initial shortlist.

International experience is another recurring advantage. It is commonly stated that 76% of Polish IT firms have global clients, which signals familiarity with cross-border delivery norms, documentation standards, and stakeholder communication habits.

Clear communication can make or break distributed delivery, even when the engineering is strong. Poland is often highlighted for solid English capability, and the EF English Proficiency Index is frequently cited as a reference point when teams discuss how smoothly developers can handle documentation, agile routines, and day-to-day coordination with international stakeholders.

Why Poland Beats Other Outsourcing Countries

Though Poland is one of the leaders in the CEE region, it’s not the only favorable location for hiring top software developers and outsourcing software development. To help you navigate the Eastern European outsourcing landscape better, we’ve compared Poland to Romania and Bulgaria.

|

Criterion |

Poland |

Romania |

Bulgaria |

|---|---|---|---|

|

Talent Pool Size |

600,000 |

250,000 |

90,000 |

|

Number of IT Companies |

50,000 |

7,290 |

10,000 |

|

Number of R&D Centers |

7,431+ |

30+ |

50+ |

|

Data Security and Compliance |

Full compliance with EU regulations, including GDPR |

Complete adherence to GDPR and all relevant EU data privacy regulations |

Full match with EU requirements |

|

Business Stability |

Mature and stable |

Decent regulatory environment |

Economic vulnerability may cause issues for long-term outsourcing projects |

|

English Proficiency |

Very high proficiency |

Very high proficiency |

High proficiency |

|

IT Market Specialization |

Cybersecurity, fintech, and e-commerce |

Fintech, cybersecurity, and healthtech |

Fintech, gaming, and IT outsourcing |

|

Cost effectiveness (mid-level Python developer salaries compared to the USA) |

~67% |

~64% |

~69% |

Poland is frequently shortlisted because it offers a fairly stable operating environment and an IT ecosystem that’s been built up over years, not months. There are enough engineers to staff common roles without constant bottlenecks, and the skill spread covers everything from fintech and security to e-commerce work. Costs are still viewed as reasonable for the level of experience available. Meanwhile, Romania’s pricing has tightened for many companies, so teams that once defaulted there often compare options again and end up leaning toward Poland for a more predictable nearshore balance.

Real Costs: How Much It Costs to Hire Developers in Poland in 2026

U.S.-based companies and Western European countries choose Poland due to its exceptional technical proficiency and cost-efficiency. The average annual salary of Polish software developers skilled in Python is ~67% lower than wages in the USA ($38,400 in Poland vs $117,600 in the USA).

|

Annual Salary/Country |

Poland |

USA |

Cost Savings (%) |

|---|---|---|---|

|

Junior Python Developer |

$16,800 |

$84,000 |

80% |

|

Middle Python Developer |

$38,400 |

$117,600 |

67% |

|

Senior Python Developer |

$66,000 |

$160,800 |

59% |

|

Junior AI Engineer |

$30,000 |

$71,799 |

58% |

|

Middle AI Engineer |

$55,200 |

$101,752 |

46% |

|

Senior AI Engineer |

$67,200 |

$126,557 |

47% |

|

Junior Data Scientist |

$32,400 |

$77,670 |

58% |

|

Middle Data Scientist |

$60,000 |

$122,738 |

51% |

|

Senior Data Scientist |

$84,000 |

$142,460 |

41% |

|

Junior Java Developer |

$18,000 |

$70,000 |

74% |

|

Middle Java Developer |

$48,000 |

$110,400 |

57% |

|

Senior Java Developer |

$73,200 |

$156,000 |

53% |

|

Junior JavaScript Developer |

$18,000 |

$72,000 |

75% |

|

Middle JavaScript Developer |

$40,800 |

$114,000 |

64% |

|

Senior JavaScript Developer |

$67,200 |

$162,000 |

58% |

|

Junior C++ Developer |

$16,800 |

$76,800 |

78% |

|

Middle C++ Developer |

$38,400 |

$120,000 |

68% |

|

Senior C++ Developer |

$61,200 |

$162,000 |

62% |

Compensation comparisons rarely line up perfectly, but the pattern is hard to miss once roles are matched by level and tech stack. In many benchmarks, junior positions in Poland are quoted well under U.S. figures, often by about 58%–80%. Mid-level roles are commonly shown at roughly 46%–68% lower, and senior engineers typically land around 41%–62% below U.S. pay, with the exact spread shifting by technology and by how companies calibrate “seniority” from one market to another.

Bottom line for 2026 sourcing decisions

Poland is often a solid fit for European hiring when companies need dependable staffing, controlled growth, and teams used to working with international stakeholders. Even so, the real difference comes from which vendor or team is chosen, not the pin on the map. The smart move is treating vendor selection like a technical audit: check delivery habits, security standards, and how they keep teams stable. Then start with clear milestones so performance is proven early, not assumed.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

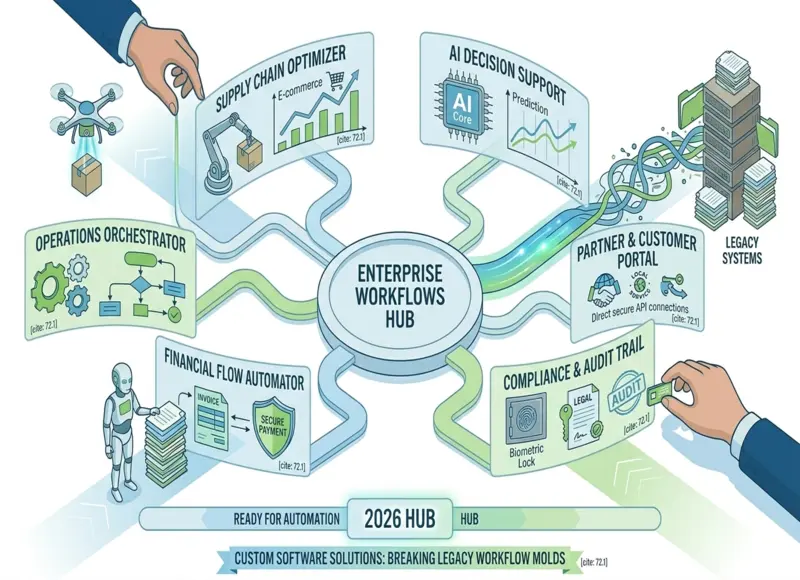

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127