Table of Contents

Create personalized finance tools effortlessly with an intuitive app builder. From custom budget trackers to dynamic savings dashboards, design simple, effective solutions tailored to your financial goals and take full control of your money management.

Managing your money doesn’t have to be stressful or boring. If you’ve ever wanted to take charge of your finances without relying on generic apps or wrangling complicated tech, an app builder might be the secret weapon you didn’t know you needed. With the right app builder, you can create personalized finance tools that truly fit your lifestyle and help you meet your goals, all while making the process surprisingly fun and approachable.

Before we dive into the creative ideas, let's see why ai app builders no code are such a great fit for anyone who wants to take control of their financial goals and needs.

- Take Control: Utilize app builders to create personalized finance tools that simplify money management and adapt to your lifestyle.

- Budgeting Benefits: Establish a structured yet flexible budget to allocate funds effectively, ensuring your money works for your priorities.

- AI Advantage: Employ AI features in app builders for automated insights and real-time updates, enhancing financial tracking efficiency.

- Custom Tools: Build specific apps like budget trackers or savings dashboards to gain clarity over spending habits and achieve your financial goals.

Why Tracking Finance Matters?

Monitoring your money closely is not only a good habit but also the grounding for long-lasting stability, the realization of your biggest aspirations, and even a reduction in your everyday anxiety. With a detailed view of your monthly expenses, you get the power to deal with your finances more wisely and knowledgeably. This, in turn, helps you to recognize those hidden habits of spending that might be restricting you and reposition your attention to what really counts for you. A great majority (77%) of the finance experts affirm or strongly affirm that FP&A delivers value-added insight.

Whether your goal is saving up for a dream vacation, finally paying off debt, or simply planning for a secure future, tracking your finances provides the clarity and control you need to confidently manage your financial health.

Creating a budget is the next step to take your financial management to the next level. A well- thought- out budget isn't about restriction, it’s about intention. By allocating your income to categories that align with your priorities, you ensure that your money is working for you.

To begin with, prepare a list of your essential expenses, such as housing, utilities, and groceries, then allocate some money for savings and paying debts. Ultimately, make sure that there is still a portion for the things that make you happy, whether it is going out to eat, hobbies, or just treating yourself now and then. A well-distributed budget offers you a mechanism while at the same time granting you adaptability, thus making it more convenient to adhere to your financial plan and to realize your long-term objectives.

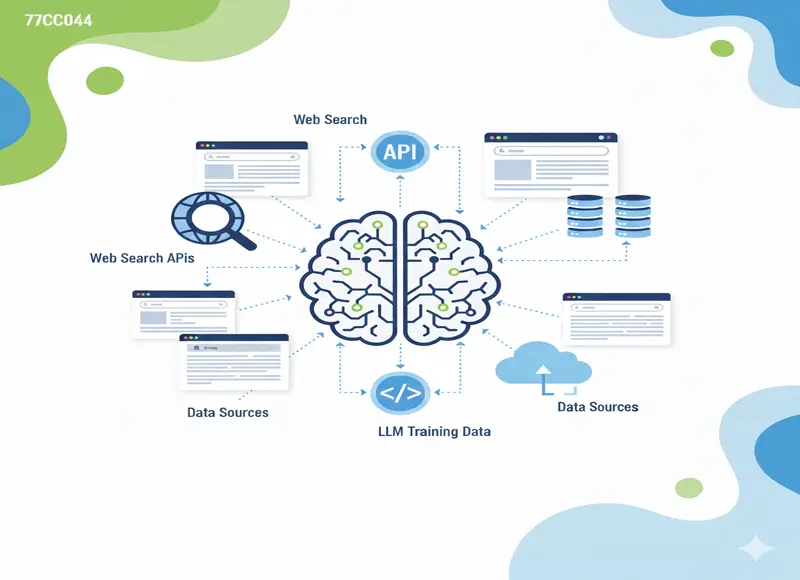

Is it True That AI Makes Everything Easier?

AI makes financial tracking easier and more accurate. AI tools, including app builders, offer real-time insights, quick updates, and helpful suggestions based on your habits. This removes guesswork and saves time. They can also simplify payroll by automating tasks, spotting patterns, and predicting needs using past data. These smart tools give you a more efficient way to manage your money, almost like having a financial advisor available anytime to guide you toward your goals.

Why App Builders Are a Smart Choice for Personal Finance Tools

App builders make it possible for anyone to craft their own solutions, no advanced expertise or coding required. They’re designed for all skill levels, using simple drag-and-drop interfaces and easy to navigate menus. You can start with a template or blank canvas, and add features like charts, forms, reminders, or dashboards as you see fit. The real beauty is flexibility: you’re free to create apps that match your routines, goals, and preferences.

Plus, since you’re building it yourself, you can make changes on the fly as your financial needs change. In short, app builders help you make smart, custom tools that actually keep up with your life.

Let’s jump into 7 personal finance tools you can create on your own with an app builder, so you can spend less time stressing about your budget and more time achieving your goals.

1. Custom Budget Tracker

Say goodbye to clunky spreadsheets that don’t fit your style. With an app builder, you can design a budget tracker that’s just right for you. Add customizable tables, input forms for expenses, and colorful charts for a bird’s eye view of your monthly spending. An app builder lets you add features that work for you, making budgeting a whole lot more approachable. Some app builders even have customizable templates, like base44.

2. Savings Goal Dashboard

Dreaming of that trip, new gadget, or a rainy day fund? Build a savings dashboard where you set your goals, track your progress, and celebrate milestones. You can add dynamic widgets and progress bars to watch your savings grow in real time. Sprinkle in motivational messages to keep yourself going, it’s all easy with an app builder!

3. Bill Payment Organizer

Avoid missed payments and late fees by creating a tool that keeps all your bills in check. Make a calendar or checklist view for your monthly bills, with custom tables and status updates. Add quick links to payment websites, and personalize the page to suit your routine. You’ll always know what’s due and when, no more surprises.

4. Debt Repayment Planner

Tackling debt can feel overwhelming, but putting a plan in place helps. Use your app builder to set up a debt repayment tool where you list each debt, track payment schedules, and visualize your progress. Add payoff calculators and priority tags to stay focused. As your balance drops, you’ll see your hard work pay off, literally.

5. Expense Categorizer

Ever wonder where your money really goes? With an app builder, create an expense categorizer that sorts and summarizes your transactions. Make custom categories, interactive charts, and auto-updating summaries. It’s all simple to personalize, so you can get powerful insights into your spending habits without any confusing formats.

6. Income Tracker

Got a side hustle, freelance projects, or multiple income streams? A custom income tracker helps you see how much you’re bringing in each month down to the last cent. Set it up with your app builder’s form fields, recurring income options, and summary tables. No more guessing if that gig has paid off, now you’ll know exactly what’s working.

7. Financial Goals Vision Board

Take your inspiration up a notch! Use your app builder to create a digital vision board that keeps your goals front and center. Pin images, set headline goals (like “Buy a new car” or “Build an emergency fund”), and track progress alongside your budget. Having this on your dashboard keeps finances fun and focused on your future.

Summary

Creating an individual finance app could transform the way you look at money management and the ever-present pursuit of your life goals. Really organized and focused regarding anything from tracking of budgets and recurring income to setting up motivational vision boards, the customized tuners will tempt you! As you harness your financial equals according to your innate needs, you get a clear view of your finances and a grip over them that only heightens your self-assurance.

FAQs

Using an app builder lets you create custom financial tools that fit your lifestyle and goals. You can personalize budget trackers, savings dashboards, and bill organizers with no coding required. User-friendly drag-and-drop features make building financial solutions simple for anyone.

When building a budget with an app builder, start by listing your main expenses, savings goals, and non-essential costs. Use tables or charts to track your income and spending clearly. Create categories based on your priorities to balance saving and enjoyment. Update the app regularly to reflect any income or expense changes so your budget stays accurate and useful.

AI is an indispensable tool for app developers, owing to the automated insight as well as the means of informative and real-time feed of the expenses running for proper money management. The AI technique determines and categorizes the expenses, follows the line of prevalent patterns in spending, and can forecast the money required in the future, thereby removing uncertainty and enabling users to focus on other aspects of their money management strategies.

With an app builder, you can create various personal finance tools, including a custom budget tracker, savings goal dashboard, bill payment organizer, debt repayment planner, expense categorizer, income tracker, and a financial goals vision board. Each of these tools can be personalized to meet your specific financial management needs, providing clarity and insight into your financial health.

Recent Blogs

9 Operational Excellence Strategies: How Leading Enterprises Optimize Performance

-

24 Dec 2025

-

6 Min

-

194