Table of Contents

Transform your business operations with our cutting-edge Approval and Accounts Payable Software Solutions. Designed to streamline workflows, this software automates approval processes and simplifies invoice management.

Managing invoices, approvals, and vendor payments can get overwhelming fast. As your business grows, it only gets harder. The process can be long and full of mistakes, from keeping track of bills to getting the correct people to approve on time.

That's where software for approvals and accounts payable (AP) comes in. These tools make it easier to do financial activities. They help your team get things done faster and with fewer mistakes. In this blog, we'll talk about how AP software makes things run better. We'll also talk about the main features, how to set it up, and how to cut down on delays.

Using Automation Tools To Handle Invoices

It's not efficient to use emails and spreadsheets to deal with invoices. It causes mistakes, delays, and occasionally even lost payments.

Tools that automate tasks make things easier. They make it easy to get, process, and store invoices. When an invoice comes in, the software either scans it or gets it digitally. It sorts the invoice and sends it to the relevant person to sign off on it.

Here's how automation helps:

- Fewer mistakes when entering data

- Faster approvals

- More information on the status of invoices

This saves time and keeps your money in order.

Key Features to Consider

There are different kinds of AP tools. You should pick one that works for your business. These things are crucial.

Look for:

- Approval Workflows that can be changed

You should establish rules depending on invoice amount, department, or other factors.

- OCR (Optical Character Recognition) for invoice capture

OCR gets information from scanned documents. It saves time on manual entry.

- Working with accounting software

Your Account Payable tool should work with other programs, like QuickBooks or NetSuite. This cuts down on having to enter the same information twice.

- Real-Time Alerts and Messages

Get notifications when an invoice needs to be approved. This stops delays.

- History Logs and Audit Trails

Keep track of everything that happens with an invoice. This makes it easier to keep track of things and hold people accountable.

Choose a tool that is easy to use, works on mobile devices, and can be changed.

Steps to Implementation

It can be easy to switch to AP software. This is how to accomplish it step by step.

Step 1: Review Your Current Process

Check out how your team deals with bills right now. Identify the pain points.

Step 2: Choose the Right Tool.

Pick software that works for your team size, needs, and budget.

Step 3: Set Up Workflows

Set up rules for who can approve each invoice and when.

Step 4: Teach Your Team

Teach your team how to use the tool. Give out demos and guides.

Step 5: Begin with a small amount

Try it out with one team or department. Then grow throughout the company.

Start slowly, learn, and then get bigger.

The Best Ways To Speed Up The Approval Process

Software is helpful, but you still need a process that works well. Here’s how to reduce delays.

Use These Tips:

Reminders that happen automatically

Set the tool to email follow-ups when bills are late.

Approval Limits

Let minor bills get accepted without any further checks.

Clear communication

Use comments on the tool instead of extended email threads.

Sending in a standard invoice

Tell vendors to use the same format. It makes it easy to process.

These ideas help you get approvals faster and build better relationships with vendors.

Integrating Financial Software for Smooth Data Flow

It's confusing to use different systems. If tools don't talk to each other, you have to perform twice as much work.

Integration takes care of that. Data flows smoothly when your AP tool works with your accounting or payroll solutions. For instance, you can send an accepted invoice straight to your accounting software.

Benefits of Integration

- Less work by hand

- One place to find accurate financial information

- Instant access to cash flow information

Choose tools that relate nicely to what you already use.

Standardization of Data Formats

It depends on who provides the invoice and how it looks. Someone can say "Total Amount" or "Invoice Total." This makes things unclear.

It helps to make data formats the same. AP tools often use templates or change formats on their own. That keeps everything the same.

Why It Matters:

- Makes data easier to comprehend and compare.

- Fewer errors when reviewing

- Better audits and reports

Consistency makes things and processes clear for your team.

Improving Visibility and Control Over Spend

One of the best things about using approval and Accounts Payable software is that it helps you keep better track of your business's spending. It's easier to keep an eye on who is spending what and why when everything is in one spot.

You may see real-time reports on bills that are still open, approved, or paid. You can observe patterns, find duplicate payments, or find merchants who deliver late invoices a lot.

How it helps:

- Prevents overspending by setting approval limits

- Tracks spent by department or project.

- Improves budgeting with real-time insights

You can make better financial choices and prevent surprises at the end of the month if you can see things more clearly.

Syncing data in real time

Waiting for updates makes decisions take longer. That's fixed by real-time sync. It instantly updates your info on all systems.

Everyone can notice the update straight away if someone authorizes an invoice. That helps teams work together.

Advantages of Real-Time Sync:

- Quicker choices

- Correct reports

- Data that all teams can use

Everyone sees the same info at the same time.

Cost Savings and ROI of AP Automation

One of the main reasons firms buy accounts payable software is to save money over time. Your staff can focus on more important things when they don't have to do as much manual work. Automation cuts down on the number of people needed to sort bills, send reminders, or check data again. When you look at how much time, money, and mistakes you can prevent, the value becomes evident.

Key Benefits:

- Less manual work means lower staffing costs

- On-time payments reduce penalty fees.

- Early payments can earn a vendor discounts.

- Fewer errors and better fraud control

- Scales easily as your business grows

Over time, these savings add up. The return on investment comes from faster approvals, fewer mistakes, and smarter spending.

Final Thoughts

Account Payable and approval software help you get things done faster and more efficiently. Your team can stay focused and avoid mistakes with automation and integration.

Look at how you do things right now to get started. After that, pick the proper tool. Set up workflows, train your team, and roll them out in phases. Avoid slowdowns by using sensible strategies like reminders and explicit regulations.

Your business runs more smoothly when your systems talk to each other and data is always up to date.

If you need help choosing the right tool, look at lists made by experts on sites like SelectedFirms. You can select tools that work for you and your budget.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

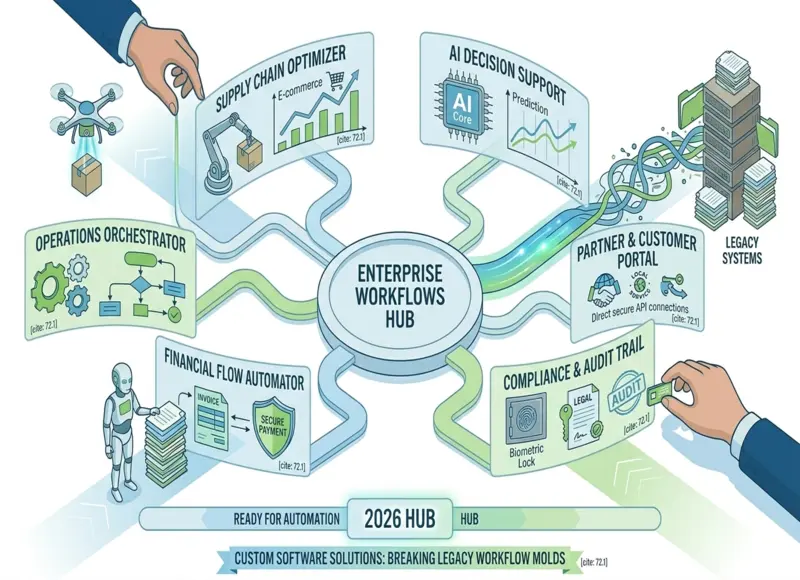

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127