Meesho Rival CityMall Secures $47M to Boost Private Label Growth

-

Last Updated:

05 Sep 2025

-

Read Time:

5 Min Read

-

Written By:

Ashutosh Tripathi

Ashutosh Tripathi

-

3308

CityMall, a rising rival to Meesho, has raised $47M in Series D funding led by Accel. The Bharat-first platform will use the capital to expand private labels, deepen regional presence, and strengthen its low-cost supply chain to better serve Tier 2 and Ti

Key Facts:

- CityMall raised $47 million (approx. Rs 414 crore) in Series D funding led by Accel, with participation from existing investors including Waterbridge Ventures, Citius, General Catalyst, Elevation Capital, Norwest Venture Partners, and Jungle Ventures.

- Founded in 2019 by Angad Kikla, Naisheel Verdhan, and Rahul Gill, CityMall targets underserved Tier 2, Tier 3, and smaller town markets with a unique community-led e-commerce model.

- The fresh funding will be used to expand private label offerings, deepen regional penetration, and enhance low-cost supply chain infrastructure.

- CityMall’s cumulative funding has reached about $165 million; valuation is approximately $320 million.[Economic Times]

- The platform empowers local community leaders as resellers and logistics partners via WhatsApp and a mobile app to serve customers efficiently.

- CityMall competes directly with Meesho, a larger social commerce platform that recently completed its redomicile to India and is IPO-bound.

- CityMall focuses on the "Bharat-first" approach addressing affordability and trust in smaller towns, contrasting with metro-focused convenience-first e-commerce platforms.

CityMall’s Strategic Position as a Meesho Rival

CityMall, launched in 2019, has rapidly positioned itself as a prominent rival to Meesho in India’s burgeoning social commerce and e-commerce sectors. While Meesho predominantly targets large-scale reselling via broad social media networks, CityMall adopts a community-driven approach tailored to smaller towns and rural India, reaching places where traditional e-commerce has lagged.

The company's founders - Angad Kikla, Naisheel Verdhan, and Rahul Gill - have crafted an innovative model where local "community leaders" operate virtual stores on platforms like WhatsApp. These micro-entrepreneurs utilize CityMall’s technology and analytics, taking orders from their social network and managing last-mile delivery, earning commissions. This community-led supply chain drastically cuts costs and builds trust in regions largely ignored by metro-centric platforms.

Accel Partners, leading the recent $47 million funding round, cited CityMall’s differentiated "low-cost supply chain" and "value commerce" model as a key enabler making e-commerce viable for underserved Indian consumers.

The $47 Million Funding Round and Growth Prospects

In its latest Series D round, CityMall secured $47 million led by Accel, alongside longstanding backers like Waterbridge Ventures, Citius, General Catalyst, and others. The funding round maintained a flat valuation at around $320 million, reflecting market stability amid some volatility in early 2025.

CityMall plans to deploy this capital into three core areas: expanding its private label portfolio; scaling its low-cost and highly efficient logistics network deeper into Tier 2-4 towns; and enhancing technology and product capabilities by recruiting top talent. Private labels are a significant focus as they offer better margins and can drive stronger consumer loyalty in price-sensitive Bharat markets.

Financially, the company has posted healthy revenue growth (FY24 revenue INR 460 crore, 22% up from FY23) but continues to operate at a net loss due to aggressive investments in infrastructure and customer acquisition. This is typical for fast-growing startups in the segment. CityMall's goal is to move toward profitability by leveraging scale and private label economics.

CityMall’s “Bharat-First” Philosophy vs. Metro-Centric E-commerce

CityMall’s founders emphasize that India’s next growth wave will come from “small towns and communities,” a demographic underserved by existing online marketplaces built around metro convenience and high pricing.

Traditional e-commerce in India relies on expensive supply chains and urban-focused assortments. CityMall, in contrast, configures its entire value chain - product mix, pricing, delivery - to meet the expectations and income levels of Bharat’s tier 2, 3, and lower-tier cities. This includes offering vernacular language support and simplified app interfaces aimed at new, value-conscious internet users.

By empowering community leaders who are native social platform users (such as WhatsApp native buyers and resellers), CityMall taps into trusted social networks, which helps keep customer acquisition costs down and builds loyalty.

The Competitive Landscape: CityMall vs. Meesho

Meesho remains the dominant social commerce platform in India, known for its massive reselling network and imminent IPO post-redomicile to India. Meesho reported a valuation surge to around $10 billion, reflecting investor confidence. Its focus is broadly on expanding reselling and marketplace operations across India’s metro and non-metro markets.

CityMall competes by focusing more intensely on smaller towns and a community-driven value commerce approach that includes a broader product assortment (from groceries to household essentials). Meesho’s recent IPO preparations and funding reflect its scale, but CityMall’s focused Bharat-first, private label, and logistical differentiation carve a unique niche in the pricing-sensitive lower-tier cities.

Market and Investor Sentiment Toward CityMall and Social Commerce

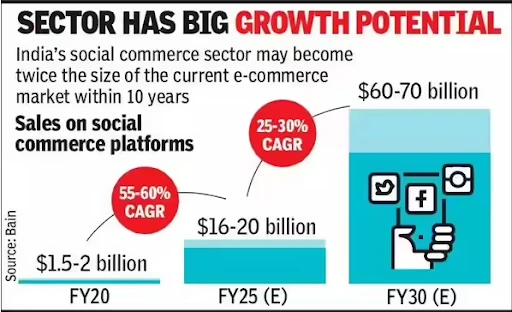

Investors are bullish on the social commerce and community-led e-commerce model in India’s digitally expanding Bharat. The recent $47 million round underscores continued confidence in CityMall’s vision. Accel and partners praise its efficient logistics and community-led reseller network - key innovations in lowering costs and improving consumer trust.

Social commerce is expected to be a multi-billion-dollar opportunity in India, driven by new internet users in non-metros, and CityMall’s funding marks it as a noteworthy contender alongside Meesho and emerging players. However, the startup is still investing heavily and is not profitable yet, highlighting the competitive and capital-intensive nature of the segment.

Recent News

Crocs Reinvents Its Iconic Clogs as Trendy Phone Cases with SLBS Collaboration

-

08 Sep 2025

-

6 Min

-

3863