Table of Contents

Dive into the world of software development and its crucial role in revolutionizing annuity products. Stay informed on the latest technologies driving change in the sector.

Annuity products have always significantly offered sustainable income, especially when most retire. However, what has been seen in this technologically-elevated world is the fact that the annuity model is slowly changing due to the developments. Thus, software development is one of the critical components in this modernization process, which helps financial institutions introduce new flexible, efficient, and customer-oriented annuity products. This article offers a comprehensible insight into how software development enhances annuities regarding product design and, more importantly, customer experience and operational productivity.

1. Enhancing Product Design and Flexibility

Through software development, fashioning more versatile and adaptable annuity products becomes possible. "Technological advancements mean financial institutions can develop annuities that meet the needs and wants of respective clients concerning their income and economic needs and objectives.

For example, it is possible to apply big data and complex computation techniques to develop an individually tailored annuity plan based on the custom customer's profile, the age at which they plan to retire, and the income level desired during retirement," says Scott Dingman, CEO of Structured Settlement Buyout.

This level of customization was not possible with the steady conventional annuities that call for here. Also, such tools can forecast different combinations of economic parameters and show customers the output of their investment plans.

2. Streamlining the Underwriting Process

However, underwriting of annuities, for example, has proved that the employment of higher paperwork and manual review of the documents no longer exists because of the extent of the software development. "Audited underwriting systems also have efficient methods for assessing risk, analyzing applicant data, and making underwriting decisions. This reduces time, decreases the failure and mistakes that may happen during the underwriting process, and increases the accuracy and control of underwriting. The customers can complete the applications more quickly and, in turn, get the products of their choice from the annuity faster. Moreover, such systems can update the obtained data and enhance their performance with time." says Sarah Jeffries, Director of Paediatric First Aid.

3. Improving Customer Engagement and Experience

Customers have enhanced their engagement with annuity products due to the availability of various technologies. Customers can obtain detailed information on their annuities and monitor their investments with the help of tools such as applications and Websites. Such sites usually offer varying tools enabling the customers to calculate and simulate annuity plans to meet the client's needs.

Better interfaces and more targeted communication add to the customers and let individuals understand the details of their annuities more easily," says Lauren Taylor, Marketing Manager at Emergency First Aid At Work Course. Also, such platforms can offer customers relevant and timely information and notifications regarding their shares.

4. Leveraging Data Analytics for Better Insights

Data analytics are the core of the modernization strategies of annuity products. "Big data and advanced analytics provide an opportunity to understand customer needs, market conditions, and other factors affecting financial institutions. Such understandings help companies create newer – and better – annuity products with which to compete and discover potential means of enhancing current products.

Also, predictive analytics can help anticipate the future supply and demand in the market and, therefore, potential future customers for improvements in the product," says John Hughes, CEO of ContractorNerd. Such an approach makes it possible for financial firms to maintain the extension of annuity products as potentially viable products in a constantly changing world.

5. Ensuring Compliance and Security

The financial services industry is highly regulated, and the business must move ahead with the legislation. Software development has eased compliance with such legal requirements as reporting, record-keeping, and enforcement of solid security features. Secure technologies like customer information encryption and using user identities as passwords guarantee secure customer information and transactions.

These technologies assist financial organizations in sustaining credibility and professionalism besides meeting regulatory requirements," says Sam Hodgson, Head of Editorial at ISA.co.uk. Moreover, such software can also be used to notify when there are modifications in federal laws so that clients can continue complying with the law.

6. Enhancing Operational Efficiency

Customer satisfaction has become an essential strategy in the intensified financial services industry. Software development assists in the rationalization of several back-office activities, such as processing policies, claims, and client inquiries. Automated systems are labor-saving and time-saving, eliminating most human errors and making service delivery cheaper and more efficient.

People in financial institutions can channel their resources more prudently, reducing concentration on unimportant activities and concentrating more on customer-oriented initiatives," says Ben Flynn, Marketing Manager at 88Vape. For instance, automated claims processing can effectively and efficiently address customers to enhance their satisfaction while cutting operation costs.

7. Facilitating Innovation and Product Development

The most crucial factor that cannot be overemphasized is the capacity to innovate, a necessary attribute to survive in the financial services industry. One key benefit of annuity product software development is the creation of fast prototypes of the newer product solutions that have a window to be tested and launched in the market. The continuous improvement and iteration of the product caused by applying agile development methodologies and DevOps practices help meet custom customers ' needs and increase product competitiveness in the market," says Holly Cooper, Marketing Manager at LUCAS PRODUCTS & SERVICES.

This reverse facilitates innovation and responsiveness in the environment of financial institutions as a result of agility. In this way, with the help of adaptive feedback, companies can improve their products, keeping up with customer demands.

8. Integrating with Emerging Technologies

Software development is also used to efficiently use annuity products through technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT). Chatbots and virtual assistants will also benefit the customer as they will help support the customers depending on their needs for AI. Blockchain technology brings solutions for secure, transparent, and immutable records management in the context of annuity transactions. IoT devices have the potential to capture real-time data that insurers can use to assess their customers and, hence, come up with better-suited annuity products," says Adam Crossling, Marketing & New Business Director at zenzero. Altogether, these technologies help develop more mechanisms of change and connectivity in the financial world.

Conclusion

The usage of software in the development process is central to refreshing annuity products through flexibility, effectiveness, and relations with customers. Thus, progressive technologies and strategies should focus on delivering more appealing and competitive annuities to clients.

This change, however, opens up the company by making it operate more efficiently, have proper compliance, and, at the end of it all, ensure that its customers are also happy. In the future, with the development of technologies, additional hi-tech solutions will deepen the changes in the structure and nature of annuities, thus strengthening their presence in the digital environment.

Adopting software development is crucial for financial institutions that aim to be at the forefront of the new style annuity market to deliver secure, efficient, and practical solutions to meet custom customers.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

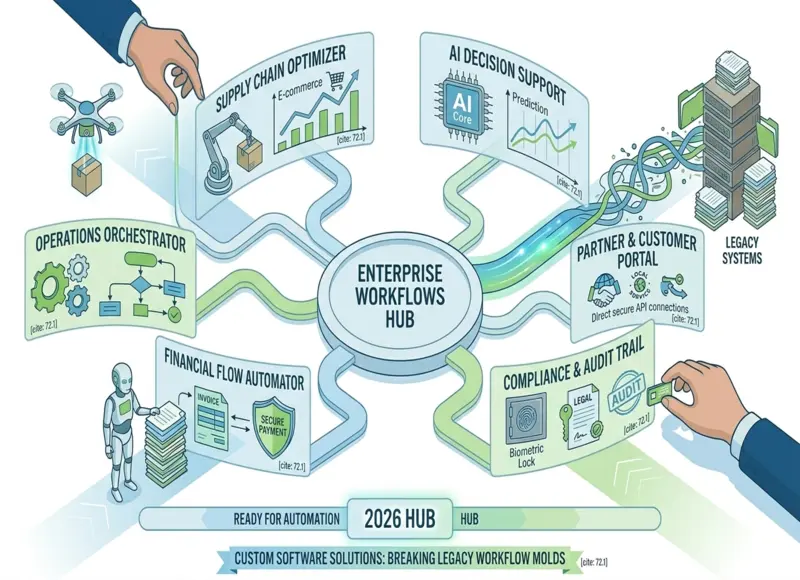

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127