Table of Contents

Understand the significance of identity verification in mobile apps to boost security and user confidence.

With mobile apps at the center of how we interact with businesses, services, and ourselves nowadays, mobile app development is an essential sector that should pay much attention to offering identity verification services. Whether a fintech, e-commerce, or social networking site, nothing feels safe enough, compliant, or trusted if one knows that it is operating with users who they seem.

This has lately been very fundamental to the development process of mobile apps, especially where sensitive data is being handled and needs to facilitate financial transactions or requires very high levels of trust by users. Identity verification in mobile apps is no longer a matter of choice but has become required as cyber threats and regulatory demands keep growing.

Why Identity Verification Matters in Mobile App Development

Enhanced security

With every new mobile application version, there are more sophisticated hacker and fraudster strategies. Businesses and users must address issues like identity thefts, account takeovers, and fraudulent activities. Incorporating advanced identity verification procedures, including document verification, biometric authentication, and two-factor authentication (2FA), will protect developers' users' account information from cyber attacks.

Compliance with Regulations

Finance, health, and insurance are significantly regulated industries. Such apps would have to follow all the strict compliance standards associated with them, such as Know Your Customer (KYC) and Anti-Money Laundering (AML). Implementing and using identity verification services, such apps stay compliant with local and international laws, thus reducing the probability of facing legal issues or penalties for non-compliance.

Building User Trust

One of the factors in success that mobile applications rely heavily on is trust. Users need confidence in their information protection and assurance that the app will protect them from fraud. A developer, by implementing the identity verification service, can truly build this trust to ensure user safety and data privacy. This attracts more users to the application while also enhancing their retention.

Preventing Fraud

Identity verification protects against fraud by eliminating the chances of fraudulent activities, such as creating fake accounts, phishing scams, and unauthorized transactions. Thus, as developers check every account, the possibility of a bad guy making an invalid account is minimized by protecting his genuine identity for the client.

Key Methods of Identity Verification for Mobile Applications

There are many different ways in which app developers might identify their users; each has their own strengths and appropriate use cases. Some of the most commonly used are shown here:

Biometric Authentication

Biometric authentication is based on using unique physical features of a specific person, such as fingerprints, facial recognition, or voice patterns, to authenticate that person. Mobile apps incorporating biometric verification benefit from a secure and hassle-free method of ascertaining users' authenticity. Because highly advanced smartphones have become widely available with embedded biometric sensors, this method has become increasingly popular for apps requiring fast, frictionless login experiences.

Document verification

Document verification verifies issued government IDs, such as passports, driver's licenses, or national ID cards scanned from those documents. It is often used with biometrics or other kinds of verification. In finance or legal service apps, this ensures the users are actual users and have permission to perform a specific action.

Two-factor authentication

2FA In this system, a user must give two distinct means of identification to access a system or execute transactions. This can be something the user knows, possibly a password, and it is something the user possesses, possibly a smartphone, in order to receive a verification code. Overall, this provides an additional security layer, minimizing the risk or chance of unauthorized access into mobile applications.

Social Authentication

It relies on the user's social media accounts to verify identity. The one benefit it has over using biometrics or documents for verification is that users can authenticate themselves on the application. However, it offers relatively inferior security compared to other methods and thus serves best for relatively less secure requirements by applications like social and entertainment media.

Liveness Detection

Liveness detection is the verification technology that confirms whether the individual submitting biometric information—in this case, a selfie—is human and indeed alive rather than a photograph or video replay. The method is mainly used to prevent identity spoofing, in which an attacker uses someone's photo or video to pretend to be that user.

Implementation of Identity Verification in Mobile Apps Best Practices

One of the trade-offs between identity verification and user experience is a delicate balancing act for developers: The verification process must be simple, fast, and not intrusive for the app user. Too long or complicated verification processes can annoy users enough to deter them from using an app, bringing abandonment rates too close to 100%. The best ways developers can attain frictionless experiences with all-around high security involve biometric authentication or social verification.

This is the collection of sensitive personal data for identity verification purposes. While designing these systems, one of the most important requirements by the developers is a focus on user privacy. They must ensure that the collected data is encrypted, stored safely, and used only for collection. Avoiding such heavy fines requires compliance with privacy regulation norms like GDPR or CCPA.

Expansion and Flexibility

As mobile applications grow, so do the users and the complexity of security threats. Therefore, developers should identify identity verification solutions that can scale with an application's growth while offering flexibility to adapt to changing regulations and user needs.

For example, cloud-based identity verification services are scalable and allow apps to process verification requests from a growing number of users promptly.

Multifactor Authentication

Whereas authentication or document verification using biometrics would be very robust, utilizing more than one verification method may provide more assurance. Multifactor authentication refers to using two or more verification methods, including a scan for a biometric combined with a one-time password. This enables best practice utilization of sensitive apps, such as banking and healthcare-related activities.

Industries that will Benefit from Identity verification in Mobile Apps

Fintech and Banking: Mobile banking apps operate under the utmost identity verification to meet the know-your-customer rule and prevent fraud. Users must verify their identity when opening a new account, executing transactions, or viewing sensitive information. Generally, fintech apps use biometric authentication, 2FA, and document verification to reinforce security and trust.

Health Care

Mobile applications or health care applications allowing patients to view and access their medical records, book appointments, or even write to doctors necessitate safety in protecting sensitive medical information. It is essential to ensure that users are authenticated and identified to prevent unauthorized access in compliance with regulations such as the HIPAA (Health Insurance Portability and Accountability Act).

E-commerce

Online commerce apps also require identity verification so that a transaction becomes secure and payment can occur without fraud. The identity verification feature added to these commerce apps reduces the risks of chargeback, identity theft, and other forms of fraud.

Social Media Apps

Although social media applications don't require as high security as banking applications, identity verification will prevent many artificial profiles, catfishing, and other malicious activities from appearing. It is especially useful in dating applications, professional networking services, and marketplaces, where the reliability between parties is highly critical.

Wrapping up

Identity Verification - a Bastion of Secure Mobile Development

The growing strides in the evolution of mobile apps mean that protection around the user and their data must evolve. Identity verification is no longer a feature but a requirement for developing safe, compliant, and user-friendly mobile applications. Integrating complex verification services allows developers to improve security levels, reduce fraud cases, and obtain users' trust to ensure their applications remain innovatively safe within the increasingly complicated digital landscape.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

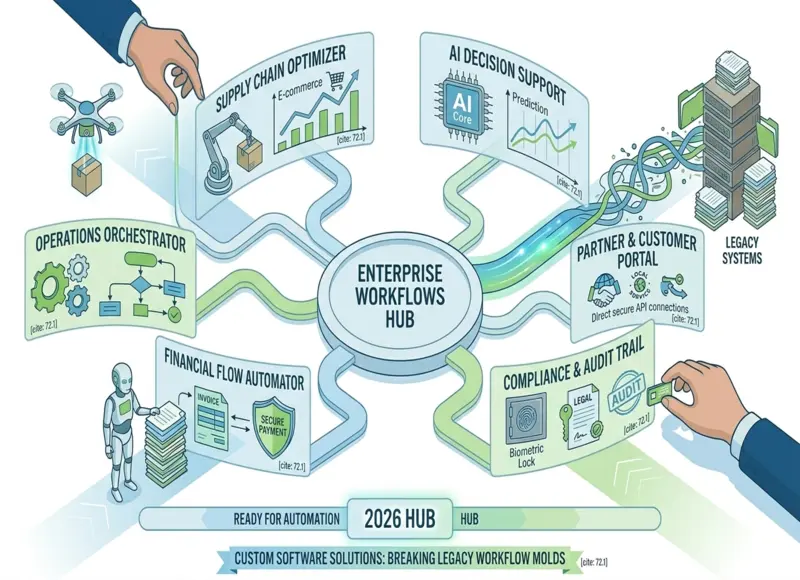

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127