Table of Contents

Maximize your software company's potential by selecting the appropriate business structure. This guide breaks down each type, highlighting key factors.

Any time you launch a new business, you face countless decisions. When starting your own software company, you may face critical choices about what kinds of software to develop, which markets to target, how you’ll finance your efforts and more.

Foremost among these decision points is your choice of business structure. The business structure you choose for your software company may have a long-term effect on nearly every other aspect of your company, including the types of funding you can secure, the tax burdens you’ll face, and your level of regulatory scrutiny.

So, what are the different business structures your software company might choose from? And what are the pros and cons of each? In this in-depth guide, you’ll learn the basics of the four primary business structures: Sole Proprietorships, Partnerships, Limited Liability Companies (LLCs), and Corporations.

Sole Proprietorships

We’ll start with the most basic business structure, the Sole Proprietorship.

A Sole Proprietorship is a business where one person calls all the shots. If you’re the sole proprietor, you alone are in charge of decision-making and day-to-day business administration. It also means that you alone claim the business revenues and any losses or liabilities.

This is the default position for new entrepreneurs. When you start making money via self-employed activity, the government will automatically classify you as a Sole Proprietor until you register as an LLC or a Corporation.

In a Sole Proprietorship, there is no legal distinction between the business and its owner, and thus, there is no way to distinguish personal assets and liabilities from business ones. The big downside here is that if someone brings a lawsuit against the business, they are bringing it against the owner, and there is no shield or safeguard for personal liability. This should be a major consideration in a litigious industry like software development.

Pros of a Sole Proprietorship

Some of the primary strengths of this format include:

- Pass-through taxation (no need to file a separate business tax return or to pay “double taxation”).

- Ease of administration and minimal regulatory oversight.

- Full independence and autonomy in decision-making, with no requirement to assemble a Board of Directors.

Cons of a Sole Proprietorship

Some of the downsides of this format include:

- No personal liability protections or safeguards against litigation.

- No way to transfer ownership of the company, as in a succession plan.

- Legal complications when hiring employees.

Partnerships

A second option for structuring your software company is as a Partnership.

In most respects, Partnerships function in the same way as Sole Proprietorships. The key difference is that you can allocate duties, responsibilities, profits, and losses between two or more business partners. As such, this is the superior option if you’re looking to make your software company a collaborative enterprise.

Overall, though, the pros and cons are the same as they would be with a Sole Proprietorship.

Pros of a Partnership

Some of the primary strengths of this format include:

- Pass-through taxation (no need to file a separate business tax return or to pay “double taxation”).

- Ease of administration and minimal regulatory oversight.

- Ability to collaborate and share responsibilities with business partners.

Cons of a Partnership

Meanwhile, the downsides of this format include:

- No personal liability protections or safeguards against litigation for you or your partners.

- Legal complications when hiring employees.

LLCs

A third option to consider is the LLC. LLCs have existed since the 1970s, and while the format was originally designed for real estate ventures, it has become popular across all industries and sectors, including software development.

What’s important to note about an LLC is that, by registering one, you’ll establish your company as its standalone legal entity, distinct from its owner. This means the business maintains its assets and liabilities, which you can keep separate from personal assets and liabilities. This affords personal liability protections, meaning you’ll be safeguarded against potential litigation to an extent impossible with a Sole Proprietorship or a Partnership.

LLCs confer professional credibility that you generally don’t experience with Sole Proprietorships or Partnerships. Simply put, taking the time to register an LLC shows that you’re serious about your business; it’s not a hobby or a side hustle. This makes it easier to earn the trust of potential lenders.

LLCs do not allow you to sell shares or take your company public. If you dream of making yours the next big publicly traded software giant, you’ll need to consider the Corporation.

Pros of an LLC

Some of the main strengths of this format include:

Pass-through taxation (no need to file a separate business tax return or to pay “double taxation”).

Ease of administration and moderate regulatory oversight.

A high degree of personal liability protection.

Ability to transfer ownership and to bring on employees as you wish.

Professional credibility, leading to improved relations with lenders and partners.

Cons of a Partnership

Meanwhile, some reasons to be wary of the LLC format might include:

There is no way to sell shares, which may make it more difficult to attract investors.

A higher degree of regulatory oversight than with Sole Proprietorships or Partnerships.

How to Register Your Software Business as an LLC

The steps for registering your business as an LLC can vary from one state to the next, which means you’ll want to double-check the requirements with your Secretary of State or Chamber of Commerce. Generally, though, the process unfolds something like this:

- Choose your state of registry. Legally, you’re allowed to register your LLC anywhere. It makes the most sense for software companies to register wherever they are based. (Seeking registration out of state is usually for real estate ventures only.)

- Select a Name. Selecting a name not already in use by another LLC in your state is required. You should be able to find a searchable online directory to confirm that the name you’d like is still up for grabs.

- Appoint a Registered Agent. Every LLC must have a person or an organization tasked with receiving legal correspondence. This Registered Agent must have a physical mailing address in the state where you’re setting up shop. For instance, when forming an LLC in Texas, selecting an Agent in the Lone Star State is mandatory.

- File Articles of Organization. Naturally, establishing a new legal entity requires some paperwork. The document to complete and file with your Secretary of State is typically called Articles of Organization, though some states use a slightly different term. When filing, you’ll also need to pay a nominal registration fee.

- Create an Operating Agreement. The Operating Agreement clarifies the roles, duties, and revenue allocation between you and your business partners. It is not legally mandatory, but it may help you defray legal tension later on.

- Establish banking. Before you begin operating your LLC, it’s advisable to establish a business bank account that’s not connected to any personal savings or checking accounts. Requesting an EIN from the IRS is necessary before you can administer payroll or file taxes.

Corporations

A fourth and final legal structure to consider for your software company is the Corporation. Like the LLC, a Corporation is a separate legal entity, and it affords you ample opportunity for personal wealth protection.

Corporations are governed by a Board of Directors, which may dilute your own authority and control over the direction of the business. Additionally, ownership in a Corporation is determined by the selling of shares.

Corporations face a much higher level of regulatory scrutiny than leveraging in-house legal software can streamline this decision-making process by providing automated compliance checks, entity comparisons, and real-time legal guidance. These benefits include the ability to take the company public, something many software entrepreneurs desire.

Pros of a Corporation

Some of the primary strengths of this format include:

- A high degree of personal liability protection.

- Ability to transfer ownership and to bring on employees as you wish.

- Professional credibility, leading to improved relations with lenders and partners.

- Ability to sell ownership shares and take the company public.

Cons of a Corporation

Meanwhile, drawbacks include:

- The potential for double taxation.

- A high level of regulatory oversight.

- Potential loss of control or influence over the direction of the company.

- Requirement to assemble a Board and to hold annual meetings.

Choosing the Right Legal Structure for Your Software Business

The decision over legal format is one of the most foundational for the ongoing success of your software business. As you consider your options, make sure you weigh factors such as:

- Taxation

- Ownership and control

- Regulatory environment

- Legal liability protections

- Funding options

- Professional credibility

While each of these business structures has its pros and cons, most software businesses will benefit from either the LLC or the Corporation, with the determining factor being whether selling shares and going public justifies a higher level of regulatory scrutiny. Consider all of these factors when deciding which format is right for your software business.

Recent Blogs

The Role of Artificial Intelligence in Modern Law Firm Growth Strategies

-

03 Mar 2026

-

6 Min

-

104

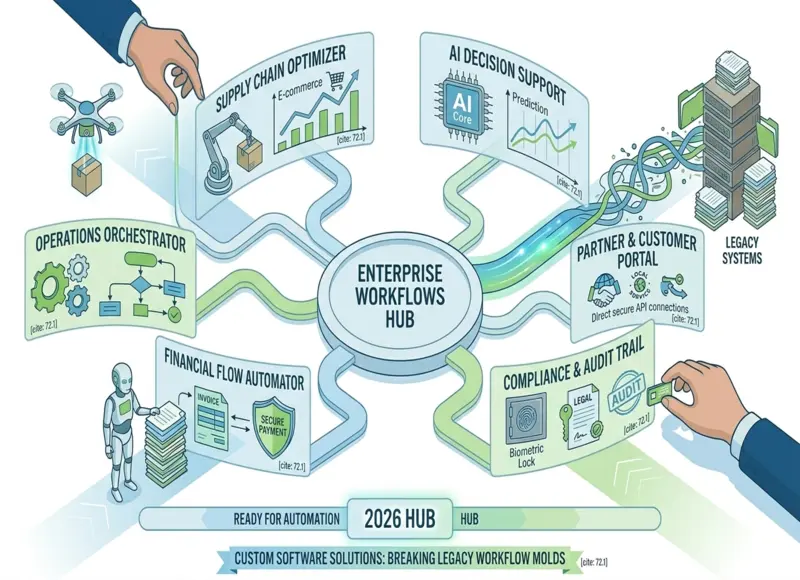

How Custom Software Companies Help Enterprises Automate Complex Workflows

-

03 Mar 2026

-

5 Min

-

127